Learn how to become an Independent Director in India with this step-by-step guide covering eligibility, DIN application, IICA databank registration, and the proficiency test for board-ready professionals.

Table of Contents

India’s corporate governance framework is rapidly evolving, and with it, the demand for qualified independent directors has never been higher.

Under the Companies Act, 2013 and SEBI (LODR) Regulations, 2015, every listed company must ensure that at least one-third of its board comprises independent directors, and where the chairperson is an executive or related to promoters, at least half the board must be independent.

The total number of companies listed on the NSE and BSE as on 31st March 2025 were 2720 and 5595, respectively. With over 8,000 listed companies across the NSE and BSE, this translates to an estimated 26,000–39,000 independent director positions across corporate India — a number that continues to grow as governance standards tighten and investor expectations rise.

For senior professionals, lawyers, accountants, company secretaries and retired executives, the independent director role offers a powerful way to stay relevant, influence strategic direction, and strengthen corporate accountability without engaging in day-to-day management.

This guide walks you through every step of becoming an independent director in India — from meeting eligibility norms and registering on the IICA Independent Directors Databank to clearing the proficiency test and securing your first board appointment.

If you’ve ever wanted to bring your expertise into the boardroom and contribute to the future of transparent, ethical, and well-governed enterprises, this is where your journey begins.

What is the meaning of an independent director?

An independent director is a non-executive member of a company’s board of directors who maintains complete autonomy from the company’s management and ownership.

Unlike executive directors who manage daily operations or nominee directors who represent specific stakeholder interests, independent directors provide unbiased oversight and protect the interests of all stakeholders—particularly minority shareholders.

The fundamental characteristic that defines an independent director is independence itself.

You cannot have any material or pecuniary relationship with the company, its promoters, directors, or management that could compromise your objective judgment. Your role is to serve as the conscience of the board, asking difficult questions, challenging assumptions, and ensuring that decisions align with the company’s best interests rather than personal or management agendas.

Independent directors play a critical role in corporate governance by ensuring transparency, maintaining ethical standards, monitoring financial integrity, and providing strategic guidance from an outsider’s perspective. You’re essentially the safeguard mechanism that prevents governance failures, protects shareholder value, and maintains public confidence in corporate operations.

Definition under section 149 and SEBI LODR regulation 16

Section 149(6) of the Companies Act 2013 provides the statutory definition of an independent director.

According to this provision, an independent director is a director other than a managing director, whole-time director, or nominee director who possesses appropriate skills, experience, and knowledge in relevant fields. The law requires you to be a person of integrity with expertise in areas such as finance, law, management, marketing, administration, corporate governance, or technical operations relevant to the company’s business.

The definition goes beyond professional qualifications to establish strict independence criteria. You cannot be a promoter of the company or related to promoters or directors. You must not have any material pecuniary relationship with the company exceeding specified thresholds. You cannot hold two percent or more of the company’s voting power, either individually or together with relatives. Additionally, you must not have been a key managerial personnel, employee, partner, or proprietor of specified service providers to the company within the preceding three financial years.

SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015, specifically Regulation 16(1)(b), further refines the independence definition for listed companies.

The SEBI LODR adds additional restrictions beyond the Companies Act, including that you cannot be a non-independent director of another company where any non-independent director of the listed entity is an independent director.

This cross-directorship restriction prevents potential conflicts that could compromise your independence. SEBI also prohibits you from being a material supplier, service provider, customer, lessor, or lessee of the listed entity.

The regulatory framework emphasizes that independence is not merely a technical checklist—it’s about perception and substance.

Recent SEBI enforcement actions, such as the Maxheights Infrastructure Limited case (June 2024), demonstrate that regulators take a holistic view. In that case, SEBI held that part-time workers of promoter entities cannot be independent directors, rejecting a narrow literal reading of the regulations. Similarly, in the InfoBeans Technologies informal guidance (May 2025), SEBI clarified that an independent director cannot assume a consultant role in a subsidiary of the listed company, even if remuneration stays below statutory thresholds.

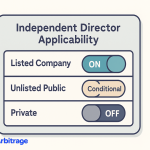

Companies that must appoint independent directors

Listed public companies bear the most stringent independent director requirements under Section 149(4) of the Companies Act 2013.

Every company whose equity shares are listed on a recognized stock exchange must have at least one-third of its total board strength as independent directors. If the calculation results in a fraction, you round up to the nearest whole number. For example, if a listed company has a board of eight directors, it must appoint at least three independent directors (since one-third of eight equals 2.67, rounded up to three).

SEBI LODR Regulation 17 further strengthens these requirements for listed entities based on board composition. Where the chairperson of the board is a non-executive director, at least one-third of the board must comprise independent directors. However, if the listed entity does not have a regular non-executive chairperson, at least half of the board must be independent directors. Moreover, if the regular non-executive chairperson is a promoter or related to any promoter or person in management positions, then at least half of the board must consist of independent directors. These provisions ensure that independent directors play a decisive role in board functioning, particularly where promoter influence is significant.

For unlisted public companies, the requirement depends on size thresholds under Rule 4 of the Companies (Appointment and Qualification of Directors) Rules 2014.

You must appoint at least two independent directors if your company is a public company and meets any of these criteria:

- paid-up share capital of ₹10 crore or more,

- turnover of ₹100 crore or more, or

- aggregate outstanding loans, debentures, and deposits exceeding ₹50 crore.

However, certain unlisted public companies are exempt even if they meet these thresholds—wholly-owned subsidiaries, joint ventures, and dormant companies don’t require independent directors.

The March 2025 SEBI LODR amendments introduced new governance norms for High Value Debt Listed Entities (HVDLEs), which are entities with outstanding listed non-convertible debt securities of ₹1,000 crore and above. These entities must now comply with board composition requirements including independent director appointments, expanding the universe of companies requiring independent directors beyond just equity-listed entities.

How to become an independent director: Eligibility

Basic eligibility criteria

Integrity and professional expertise requirements

The Companies Act 2013 Section 149(6) doesn’t specify mandatory educational qualifications, but it mandates that you possess “appropriate skills, experience, and knowledge” in relevant fields.

In my experience working with board appointments, companies look for professionals with deep expertise in law, finance, accounting, management, marketing, corporate governance, or technical domains aligned with the company’s industry. If you’re a practicing chartered accountant with 15 years of experience, you bring financial acumen. If you’re a senior lawyer specializing in corporate law, you offer legal insight. If you’ve held C-suite positions in manufacturing, you understand operational complexities.

Integrity is equally critical but harder to quantify.

The law expects you to be someone of impeccable character with no history of fraud, financial irregularities, or ethical violations. During the appointment process, companies conduct background checks through due diligence procedures, so any blemishes in your professional record could disqualify you. While there’s no mandated minimum experience, practical reality suggests you need at least 10-15 years of professional experience to be competitive, as companies seek seasoned experts who have navigated complex business challenges.

The independence test

The independence test is the cornerstone of your eligibility and goes far beyond professional qualifications to examine your relationships and financial connections.

Under Section 149(6), you must not have any material pecuniary relationship with the company, its holding, subsidiary, or associate companies during the current financial year or the two immediately preceding financial years. Material pecuniary relationship means financial transactions exceeding 10% of your total income or such higher amount as prescribed.

The test extends to your relatives under Section 2(77) of the Companies Act, which defines relatives as spouse, parent, brother, sister, and children. If your relatives hold 2% or more of the company’s voting power, have indebtedness to the company exceeding thresholds, or have pecuniary transactions amounting to 2% or more of the company’s gross turnover, you’re disqualified. This comprehensive approach ensures that family financial interests don’t compromise your independence, even unconsciously.

How to become an Independent Director: Special eligibility scenarios

Can practicing professionals (CA/CS/Advocate) become independent directors?

Yes, practicing professionals not only can become independent directors but are actually highly sought after for their specialized expertise and professional credibility. If you’re a practicing Chartered Accountant, Company Secretary, or Advocate, you’re in a strong position. Companies value the technical knowledge and regulatory expertise these professionals bring to boardrooms.

Furthermore, if you’ve been practicing for at least 10 years, you’re exempt from the online proficiency self-assessment test under Rule 6 of the Companies (Appointment and Qualification of Directors) Rules 2014—a significant advantage that recognizes your existing competence.

Here’s the critical constraint you need to understand: you cannot be an independent director in a company where you also provide professional services. If you’re the statutory auditor, company secretary, or legal counsel to ABC Ltd., you cannot simultaneously serve as an independent director of ABC Ltd.

This restriction under Section 149(6) prevents conflicts of interest that could compromise your independence. However, what you can do is serve as an independent director in completely different companies where you have no professional relationship—for example, if you’re a practicing CA providing audit services to manufacturing companies, you could serve as an independent director for a technology company, pharmaceutical firm, or financial services business, provided you don’t audit them or provide other professional services.

Can foreign nationals serve as independent directors?

Yes, foreign nationals can serve as independent directors in Indian companies, though additional procedures and considerations apply.

The Companies Act 2013 permits foreign nationals to be appointed as directors, including independent directors. However, as per MCA notifications, you’ll need to follow specific protocols during the DIN application process.

If you’re from a country that shares a land border with India (Pakistan, Bangladesh, Nepal, Bhutan, China, Myanmar, or Afghanistan), you must obtain prior security clearance from the Ministry of Home Affairs before your DIN can be allotted.

For DIN application, foreign nationals must provide passport copies as identity and address proof rather than PAN cards and Aadhaar. Your documents can be attested by the Consulate of the Indian Embassy in your home country or by a foreign public notary, ensuring proper verification even when you’re not physically present in India.

Age requirements: minimum and maximum Limits

The Companies Act 2013 does not stipulate any minimum age to become a director. Therefore, it’s presumed that any person above the age of 18 years can become a director. Again, there’s no maximum age limit specified in the Act itself for independent directors of unlisted companies, giving you flexibility throughout your professional life and even into retirement.

However, SEBI Regulation 17 of the LODR imposes stricter requirements for listed companies. The minimum age is 21 years as per Regulation 16, and the maximum age is 75 years as per Regulation 17.

If you’re above 75 years old, your appointment requires approval by a special resolution from shareholders, along with an explanatory statement justifying why your age shouldn’t disqualify you.

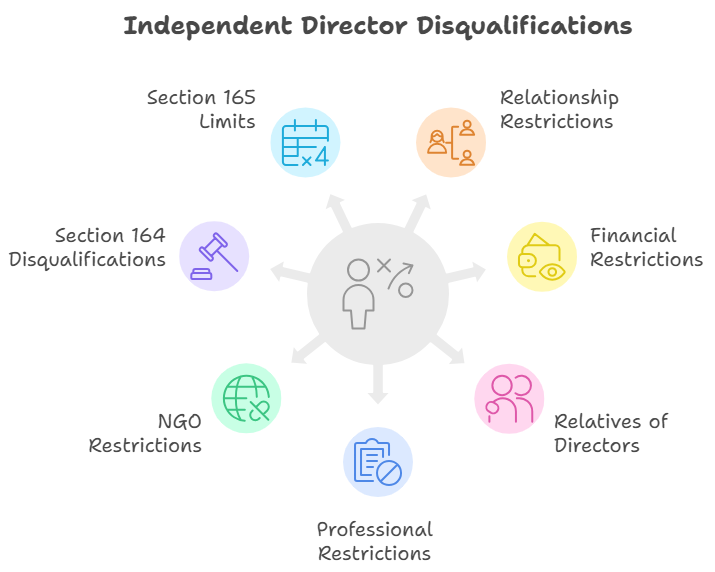

Who cannot become an independent director?

Understanding disqualification criteria is just as important as knowing eligibility requirements. Let me walk you through the comprehensive restrictions that might prevent your appointment in particular companies.

Relationship restrictions

The independence principle fundamentally requires separation from company control structures and decision-makers. These relationship-based restrictions ensure you maintain objectivity.

Cannot be a promoter of the company or its group

If you’re a promoter—someone who founded the company, controls its management, or holds substantial equity—you cannot serve as an independent director. This extends beyond just the company itself to its holding, subsidiary, and associate companies.

The logic is straightforward.

Promoters have vested interests in the company’s success and typically significant financial stakes. Appointing a promoter as an independent director would defeat the purpose of having independent oversight, as you could not objectively evaluate management decisions when you are part of the management control group.

Cannot be related to the promoters/directors of the company or its group

Relationship restrictions go beyond direct promoter status.

If you are related to promoters or directors of the company, its holding company, subsidiary, or associate company, you are disqualified.

“Related” here means close family relationships as defined under section 2(77) the Companies Act: spouse, parent, brother, sister, and children, etc.

This restriction prevents family networks from circumventing independence requirements.

Imagine if a promoter’s brother-in-law served as an independent director—would that person truly provide independent oversight, or would family loyalty influence their judgment?

The law eliminates this ambiguity by prohibiting such appointments entirely.

Financial & shareholding restrictions

Financial relationships compromise independence by creating economic dependencies that could influence your judgment. The law sets specific thresholds to maintain your economic independence.

No material pecuniary relationship with the company/group/promoter or director beyond a limit

You cannot have a material pecuniary relationship with the company, its holding, subsidiary, or associate companies, or their promoters or directors, during the current financial year or the two immediately preceding financial years. “Material pecuniary relationship” means financial transactions exceeding 10% of your total income or such higher amount as prescribed.

What does this mean practically?

If you are a consultant earning ₹20 lakhs annually and ABC Ltd. pays you ₹3 lakhs for consulting services, that is 15% of your income—a material pecuniary relationship that disqualifies you from being an independent director of ABC Ltd.

However, receiving sitting fees and commission as an independent director doesn’t count as a pecuniary relationship—that’s specifically permitted remuneration.

No relative to hold ≥2% voting power in the company or group

If your relatives hold 2% or more of the company’s voting power (either individually or together), you are disqualified. This rule extends to the company’s holding, subsidiary, and associate companies.

Here’s why this matters: A relative with 2% voting power has meaningful influence over shareholder resolutions. If your spouse or parent holds significant shares, their financial interest could unconsciously bias your board decisions, even if you believe you are acting independently.

Restrictions relating to relatives of independent directors

The restrictions extend beyond your own financial relationships to those of your relatives, recognizing that family financial interests can compromise your independence just as effectively as your own.

Holding securities above the threshold

Your relatives cannot hold or have held 2% or more of the company’s total voting power during the current financial year or the two immediately preceding financial years. This is the mirror provision of the previous restriction—it focuses on your relatives’ shareholdings rather than your relationship to shareholders.

Indebtedness to the company/group/promoters/directors

Your relatives cannot be indebted to the company, its subsidiary, holding, or associate company, or their promoters or directors. Even indirect indebtedness through a third party creates a disqualification.

This prevents scenarios where a company provides loans or credit facilities to your family members, creating obligations that could influence your independent judgment when evaluating management proposals or financial decisions.

Guarantees/security for the indebtedness of others

Your relatives cannot have provided guarantees or security in connection with third-party indebtedness to the company or its group companies, promoters, or directors, exceeding ₹50 lakhs at any time during the two immediately preceding financial years or during the current financial year.

This restriction might seem obscure, but it prevents indirect financial entanglements. If your brother guaranteed a ₹1 crore loan that a supplier took from the company, that financial connection could compromise your independence when evaluating the supplier relationship or loan terms.

Pecuniary transactions ≥2% of turnover/income

Your relatives cannot have had any other pecuniary transaction or relationship with the company, or its subsidiary, or its holding or associate company amounting to two per cent. or more of its gross turnover or total income, singly or in combination with the transactions referred to in sub-clause (i), (ii) or (iii) stated above, during the current financial year or the two immediately preceding financial years.

Suppose XYZ Ltd. has a gross turnover of ₹500 crore. Two per cent of its turnover is ₹10 crore.

If the spouse of an independent director runs a consulting firm that earns ₹12 crore from XYZ Ltd. during the financial year — whether through a single contract or multiple smaller transactions — this would cross the 2% pecuniary transaction threshold.

Even though the independent director personally has no direct financial dealing with XYZ Ltd., the relative’s substantial business with the company would compromise the director’s independence, making them ineligible to serve as an independent director under Section 149(6) of the Companies Act, 2013.

Professional and employment restriction

Past professional and employment relationships create potential conflicts even after they have ended, so the law mandates cooling-off periods.

Past 3 years as KMP/employee of company or group

If you were a Key Managerial Personnel (KMP) or employee of the company, its holding, subsidiary, or associate company within the three immediately preceding financial years, you’re disqualified. KMPs include the CEO, Managing Director, CFO, Company Secretary, and Whole-time Director.

This three-year cooling-off period ensures you have developed sufficient separation from management thinking. If you were the CFO until two years ago, your recent involvement in financial decisions could bias your supposedly independent evaluation of those same financial matters.

Partner/proprietor/employee (past 3 years) of specified service providers

You cannot have been, within the three immediately preceding financial years, a partner, proprietor, or employee of firms providing specific professional services to the company or its group:

- statutory audit firms,

- internal audit firms,

- cost audit firms,

- legal firms, or

- consulting firms receiving 10% or more of their gross turnover from the company or its group.

This restriction prevents potential conflicts from recent professional service relationships.

If your law firm earned substantial fees from ABC Ltd. until two years ago, you might find it difficult to objectively evaluate legal matters or challenge management decisions that benefited your former firm.

The 10% threshold for consulting and legal firms recognizes that some professional contact is inevitable, but substantial economic dependence creates disqualifying conflicts. If the company represented only 5% of your firm’s revenue, that’s permitted; if it represented 15%, you’re disqualified.

NGO restriction

Even seemingly benign relationships through non-profit organizations can compromise independence if financial dependencies exist.

CEO/director of NGO receiving ≥25% funds from company/group/ promoters or holding ≥2% voting power

If you are the Chief Executive or Director of a non-profit organization that receives 25% or more of its receipts from the company, its holding, subsidiary, or associate companies, or their promoters or directors, or if the company holds 2% or more voting power in that NGO, you are disqualified.

This rule recognizes that NGOs dependent on corporate funding might face pressure to align with corporate interests.

If you lead an NGO that receives ₹50 lakhs annually from ABC Ltd., comprising 30% of your NGO’s total funding, your independence as an ABC Ltd. board member would be questionable—you might hesitate to challenge decisions if you feared jeopardizing your NGO’s funding.

Statutory disqualifications

Beyond independence-specific restrictions, general director disqualifications under the Companies Act apply to independent directors as well.

Section 164 disqualifications

Section 164 of the Companies Act, 2013 sets out the circumstances under which a person becomes ineligible to be appointed as a director, including as an independent director. The provision aims to ensure that only individuals with integrity, sound financial standing, and a clean compliance record can hold directorship positions.

1. Personal and legal disqualifications

A person shall not be eligible for appointment as a director if they:

- Are of unsound mind and have been so declared by a competent court;

- Are an undischarged insolvent;

- Have applied to be adjudicated as an insolvent and the application is pending;

- Have been convicted by a court of any offence and sentenced to imprisonment for a period of at least six months, and five years have not elapsed since the expiry of the sentence;

- Have been convicted of an offence and sentenced to imprisonment for a period of seven years or more (in which case the person is permanently disqualified from being appointed as a director in any company); or

- Have been disqualified by an order of a court or tribunal which remains in force.

2. Financial and compliance disqualifications

A person also stands disqualified if they:

- Have failed to pay any call money on shares held by them, whether alone or jointly with others, for a period of six months from the last day fixed for payment;

- Have been convicted of an offence relating to related party transactions under Section 188 during the last five years;

- Have not obtained a valid Director Identification Number (DIN) or have not complied with Section 152(3); or

- Have not complied with the provisions of Section 165(1) regarding the maximum number of directorships permissible.

3. Company-level disqualifications

A person who is or has been a director of a company that:

- Has not filed its financial statements or annual returns for any continuous period of three financial years; or

- Has failed to repay deposits, redeem debentures, or pay interest or dividends for one year or more,

shall be ineligible to be reappointed as a director in that company or appointed in any other company for a period of five years from the date of such default.

However, a person appointed as a director in a defaulting company will not incur the disqualification for a period of six months from the date of their appointment.

4. Additional disqualifications by private companies

Section 164(3) also empowers private companies to prescribe additional disqualifications for directors in their Articles of Association, over and above those provided under the Act.

In essence, Section 164 establishes a comprehensive framework to ensure that individuals who have demonstrated financial impropriety, non-compliance, or lack of integrity are prevented from occupying board positions. It acts as a safeguard to promote transparency, accountability, and good governance in corporate management.

Section 165 directorship limits

Section 165 limits the number of directorships you can hold concurrently.

You cannot be a director in more than 20 companies at a time, with a sub-limit of 10 public companies.

However, for independent directors specifically, a more restrictive limit applies: you cannot be an independent director in more than 7 listed companies simultaneously in terms of Regulation 17A of SEBI (LODR).

If you are already a whole-time director in any listed company, your independent directorship limit drops to 3 listed companies. These restrictions ensure you have sufficient time and attention to devote to each directorship, preventing overextension that could compromise your effectiveness.

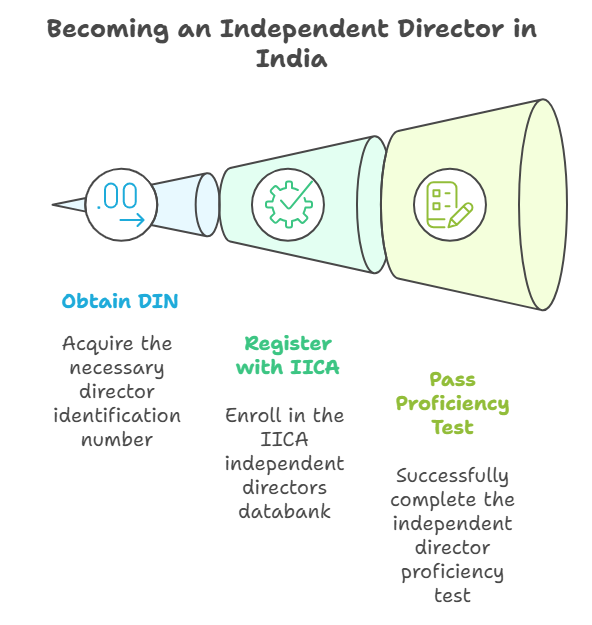

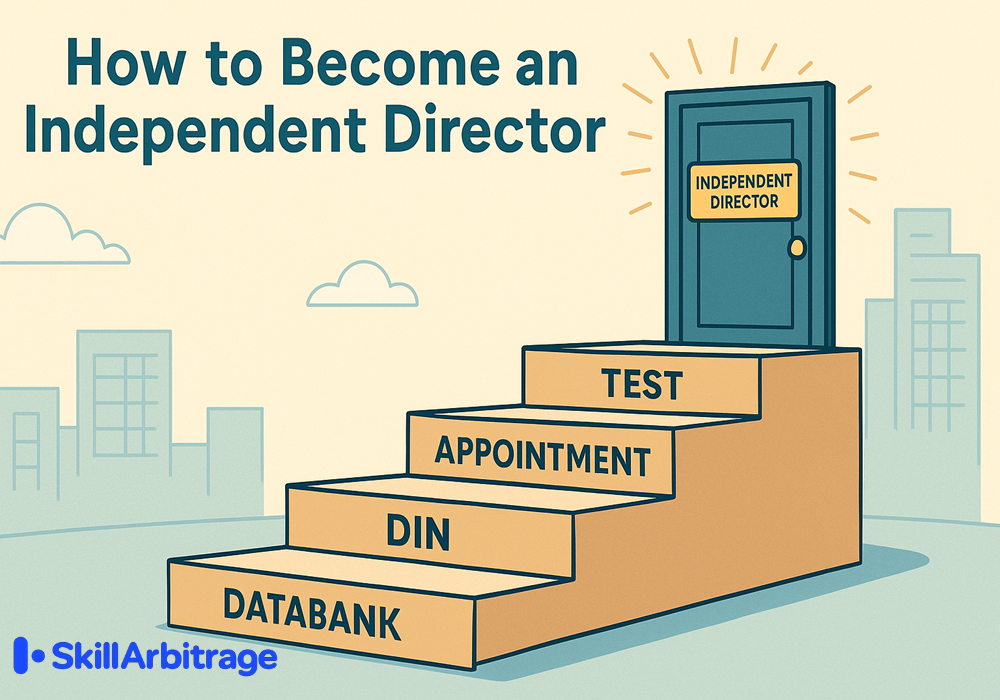

How to become an independent director in India: Steps

The pathway to becoming an independent director in India involves three core requirements that you must complete sequentially:

- obtaining your Director Identification Number (DIN),

- registering with the IICA Independent Directors Databank,

- passing the Independent Director Proficiency Test (unless you qualify for exemption)

These aren’t optional steps—they’re mandatory requirements under the Companies (Appointment and Qualification of Directors) Rules 2014.

The entire process typically takes 6-12 weeks to become appointment-ready if you work efficiently and pass the proficiency test on your first attempt. However, timeline varies based on factors like DSC procurement speed, documentation completeness, test preparation time required based on your professional background, and whether you need multiple test attempts. Understanding each step’s requirements and timeline helps you plan your journey effectively and avoid unnecessary delays.

Step 1 – Obtaining your director identification number (DIN)

Why DIN is mandatory

Your journey begins with securing a Director Identification Number, which is an 8-digit unique identification number allotted by the Ministry of Corporate Affairs to individuals who are directors or intend to become directors of companies. Think of it as your permanent professional identity number in the corporate world—once allotted, it remains valid for your lifetime and applies to all directorships you hold across multiple companies.

Obtaining a DIN is absolutely mandatory before you can be appointed as a director of any company, including as an independent director, as per Section 153 of the Companies Act 2013. Without a DIN, you cannot proceed with databank registration or appointment formalities. The DIN system allows the MCA to track all directorships held by an individual, monitor compliance with directorship limits under Section 165, and maintain a comprehensive database of directors across all Indian companies.

Documents required for DIN application

For Indian nationals, the mandatory documents are PAN card (identity proof), Aadhaar card, proof of present address (utility bill, bank statement, or rental agreement not older than 2 months), and a recent passport-size photograph. Your address proof must be current—it cannot be older than 2 months from the date of filing Form DIR-3.

For foreign nationals, you’ll provide your passport as both identity and address proof. The passport must be valid, and you should scan the pages showing your photograph, personal details, and address. If your documents are in a language other than Hindi or English, you’ll need certified translations by a professional translator or, for foreign nationals, by the Consulate of the Indian Embassy or a foreign public notary. For foreign applicants, address proof can be up to 1 year old, recognizing that foreign address verification operates on different timelines than Indian documentation standards.

Filing form DIR-3

The DIN application process occurs entirely online through the MCA portal. To obtain a DIN, Form DIR-3 must be filed with personal details including PAN, Aadhaar, photograph, proof of identity, and proof of address. The form requires digital signature and certification by a practicing Chartered Accountant (CA), Company Secretary (CS), or Cost Accountant (CMA).

Since Form DIR-3 requires professional certification and a Digital Signature Certificate (DSC) for filing, it’s standard practice to engage a CA, CS, or CMA to handle the entire DIN application process. These professionals will prepare and verify your Form DIR-3, arrange for the required DSC, certify the application, and file it on the MCA portal on your behalf. The application fee is ₹500 (subject to revision), plus professional fees typically ranging from ₹1,000 to ₹5,000 depending on the professional’s experience and location.

You can check your DIN status on the MCA portal using your PAN number if you’re unsure whether you already have a DIN from previous directorship positions.

DIN processing timeline and approval

Once Form DIR-3 is filed with all required documents and the ₹500 fee paid, the MCA processes your application.

In my experience, DIN approval typically takes 2-5 working days for straightforward applications with complete, accurate information. The MCA system automatically validates your documents against government databases where possible, such as PAN verification. If everything checks out, you’ll receive an email notification with your DIN within 24-48 hours in best-case scenarios.

However, if there are discrepancies, missing documents, or verification issues, the processing time can extend to 5-7 days or longer. The MCA might request clarifications or additional documents through the portal, which you’ll need to provide promptly to avoid further delays.

Once approved, your DIN has lifetime validity and never expires, but you must file Form DIR-3 KYC annually by September 30th to keep your DIN active.

If you fail to file DIR-3 KYC by the deadline, the MCA will mark your DIN as “Deactivated due to Non-filing of DIR-3 KYC,” and you cannot serve as a director in any company until you reactivate your DIN by filing the pending KYC form along with a late fee of ₹5,000.

Step 2 – Registering with the IICA independent directors databank

Why databank registration is mandatory

The Independent Directors Databank maintained by the Indian Institute of Corporate Affairs (IICA) was established under Section 150 of the Companies Act 2013 and Rule 6 of the Companies (Appointment and Qualification of Directors) Rules 2014. The databank serves as the official registry of all individuals willing and qualified to be appointed as independent directors, providing a transparent platform where companies can search for and identify suitable candidates.

Registration became mandatory under the 2019 amendment to the Companies (Appointment and Qualification) Rules 2014. All existing independent directors were required to register within thirteen months from December 18, 2019, and anyone intending to be appointed as an independent director must register before their appointment. Without databank registration, you cannot legally be appointed as an independent director of any company, making this a critical compliance checkpoint that you must complete.

Creating your MCA V3 account and accessing IICA portal

The registration process involves accessing the MCA portal first, then being redirected to the IICA databank portal. Begin by visiting the MCA website and clicking Login/Sign up at the top-right corner.

On the User Login/Registration page, click Register under User Login.

Select “Registered User” as the User Category and “Individual” as the User Role, enter your PAN card details in capital letters, and click Next.

Fill in your personal details including name, date of birth, gender, profession, and industry, then provide your address, mobile number, and email ID. Create a secure password and choose a password recovery question.

After clicking “Create my account” and entering the OTP sent to your registered mobile number, your registration is complete.

Your User ID will be sent to your registered email.

Once you receive it, login to the MCA portal, go to the ‘MCA Services’ tab, and click ‘ID Databank Services’ → Individual Registration.

Provide your DIN (if you have one) or PAN/Passport details, complete OTP verification, and click Proceed.

You’ll be redirected to the Independent Director’s Databank Portal, where you can login with OTP using your email ID or mobile number.

Completing your databank profile

Once logged into the IICA databank portal, you need to complete an extensive profile with personal, educational, professional, and directorship information. The personal details section requires your full name (as per PAN), father’s name, date of birth, gender, nationality, residential address (permanent and present), contact details (email and mobile), and a recent photograph. Some of this information will be pre-filled from your DIN records, but you can edit it if needed.

List all your educational qualifications in reverse chronological order, including degrees, diplomas, professional certifications, and specialized training. Include the institution name, year of completion, and field of study. Don’t just list basic degrees—include specialized certifications like CFA, PMP, or executive education programs from premier institutions, as these add to your credibility. Detail your professional experience including company names, positions held, duration, and key responsibilities, focusing on leadership roles, strategic projects, governance experience, and accomplishments that demonstrate your capability to serve on a board. You’ll also select areas of expertise from a predefined list such as finance, law, management, marketing, technology, operations, human resources, risk management, and corporate governance—choose areas where you have substantial, demonstrable expertise as companies search the databank using these expertise filters.

Subscription plans and fee structure

You must choose one of three subscription options to activate your account on the IICA databank:

- ₹5,000 + GST for 1-Year Subscription (total ₹5,900),

- ₹15,000 + GST for 5-Year Subscription (total ₹17,700), or

- ₹25,000 + GST for Lifetime Subscription (total ₹29,500).

The subscription fee includes access to all 40+ eLearning modules, mock tests for proficiency test preparation, the proficiency test itself (unlimited attempts until you pass), and continuous profile visibility to companies searching for independent director candidates.

Your subscription choice depends on your career stage and commitment level.

The 1-year subscription suits those exploring the opportunity or uncertain about long-term commitment. The 5-year subscription offers better value (₹3,540 per year versus ₹5,900 annually) and is appropriate for serious pursuit by mid-career professionals.

The lifetime subscription (₹29,500) provides best long-term value, eliminating renewal hassles and signaling strong commitment to companies reviewing your profile.

If you’re confident about pursuing independent directorship as a post-retirement career path or side role, the lifetime subscription pays for itself within 5 years compared to annual renewals and is the recommended choice based on cost-benefit analysis.

Step 3 – Passing the independent director proficiency test

Who must take the proficiency test?

The default rule under Rule 6 of the Companies (Appointment and Qualification of Directors) Rules 2014 is that everyone registered on the IICA databank must pass the online proficiency self-assessment test.

This test is conducted by the Indian Institute of Corporate Affairs under the provisions of Section 150(1) of the Companies Act 2013 and is designed to assess your knowledge of company law, securities law, basic accounting, and corporate governance principles.

You have exactly 2 years from your databank registration date to pass the proficiency test, which is a critical deadline you must take seriously.

If you registered on January 15, 2026, you must pass the test by January 14, 2028.

After that date, if you haven’t passed, IICA will remove your name from the databank. If your name is removed due to failure to pass within 2 years, you’ll need to pay a delay fee of ₹1,000 + GST to get a one-year extension as per Rule 6(5) of the Companies (Appointment and Qualification) Second Amendment Rules 2022, but this wastes both time and money, so treat the 2-year deadline seriously by setting calendar reminders at the 18-month and 21-month marks.

The test isn’t just a formality—it ensures that independent directors have baseline knowledge of their statutory duties, the legal framework governing their role, financial statement interpretation basics, and governance best practices.

Even if you’re an experienced professional, don’t underestimate the preparation required, especially if company law and securities regulations aren’t your core expertise areas. Taking time to systematically work through the IICA eLearning modules will significantly improve your chances of passing on the first attempt.

Exemptions from the proficiency test

Several categories of professionals are exempt from taking the proficiency test under Rule 6(4) of the Companies (Appointment and Qualification of Directors) Rules 2014, recognizing their existing expertise and professional credentials. If you’ve been a practicing professional for at least 10 years, you’re automatically exempt. The qualifying professions are Chartered Accountant, Cost Accountant, Company Secretary, or Advocate. “Practicing” means you hold a valid certificate of practice from your professional institute and actively practice—you’re not employed full-time by any company.

If you have at least 3 years of experience as a director (in any capacity) or Key Managerial Personnel as of your databank registration date, you’re exempt from the proficiency test.

The qualifying organizations include listed public companies, unlisted public companies with paid-up share capital of ₹10 crore or more, bodies corporate listed on recognized stock exchanges in countries that are members of the Financial Action Task Force (FATF) where the securities market regulator is a member of the International Organization of Securities Commissions (IOSCO), bodies corporate incorporated outside India with paid-up share capital of USD 2 million or more, and statutory corporations established under Central or State Acts conducting commercial activities.

Government service exemption also applies if you’ve served for at least 3 years in a Director-grade position or equivalent (pay scale of Director or above) in any Central or State Government Ministry or Department, with work involving matters relating to commerce, corporate affairs, finance, industry, public enterprises, or affairs related to Government companies or statutory corporations carrying on commercial activities.

Similarly, if you’ve served for at least 3 years at Chief General Manager level or above in regulatory bodies like SEBI, RBI, IRDAI, or PFRDA, with experience handling matters relating to corporate laws, securities laws, or economic laws, you’re exempt from the test requirement.

Understanding the test format

The independent director online proficiency self-assessment test consists of 50 multiple choice questions totaling 100 marks, divided into two categories: 25 questions on board essentials (direct-type multiple choice questions) and 25 questions on board practices (scenario-based multiple choice questions). The time limit for completing all 50 questions is 75 minutes, which means you have an average of 1.5 minutes per question.

Each correct answer awards you 2 marks.

There is no negative marking, so each wrong answer simply awards zero marks—this means you should attempt all 50 questions even if you’re unsure about some answers, as there’s no penalty for guessing.

To pass the test, you need an aggregate score of at least 50%, which means you must correctly answer at least 25 out of 50 questions.

The test covers company law (including Companies Act 2013 provisions like Sections 149, 150, 152, 164, 165, and Schedule IV), securities law (SEBI LODR regulations, particularly Regulations 16, 17, and 25), basic accounting (financial statement interpretation, ratio analysis), and corporate governance (audit committee functions, nomination and remuneration committee, stakeholder relations, risk management).

The test is conducted online with slots available every day in two time windows: afternoon slot from 2 PM to 3 PM, and late evening slot from 8 PM to 9 PM. You can book your preferred slot through the IICA databank portal once you’re ready to attempt the test. The test is proctored online, so ensure you have a working webcam and stable internet connection before booking your slot.

How to prepare for the test

Access the +40 eLearning modules available on the IICA databank platform as your primary preparation resource. These modules comprehensively cover company law, securities law, accounting basics, and corporate governance principles that form the test syllabus. If you have a legal or commerce background, you might find the material familiar and could complete it in 20-30 hours of focused study over 2-3 weeks. However, if you’re from a non-commerce background like engineering or science, plan for 30-40 hours of study time spread over 4-6 weeks to ensure you grasp all concepts thoroughly.

Create a structured study plan rather than cramming everything at the last minute.

Week 1-2: Complete company law modules focusing on Sections 149, 150, 164, 165, and Schedule IV, as these directly relate to your role as an independent director.

Week 3: Cover securities law modules, particularly SEBI LODR Regulations 16, 17, and 25, and understand listing obligations.

Week 4: Work through accounting basics modules, focusing on how to read and interpret financial statements, understand key financial ratios, and identify red flags in financial reporting.

Week 5: Study corporate governance modules covering board committee structures, audit committee responsibilities, nomination and remuneration committee functions, and stakeholder relationship management.

After completing the eLearning modules, take the mock tests available on the IICA platform to familiarize yourself with the test format, question types, and difficulty level. Take multiple mock tests to identify weak areas and reinforce your knowledge.

Aim for consistently scoring 60-70% on mock tests before booking your actual proficiency test—this buffer above the 50% passing threshold accounts for exam pressure and unexpected questions.

Focus particularly on scenario-based questions in the board practices section, as these require applying theoretical knowledge to practical situations and tend to be more challenging than direct questions in the board essentials section.

Booking and taking the test

Once you’ve completed your preparation and are scoring well on mock tests, book your proficiency test slot through the IICA databank portal.

Before your scheduled test time, ensure your computer setup meets technical requirements: working webcam (for online proctoring), stable internet connection with backup option if possible, updated web browser (Chrome or Firefox recommended), quiet environment free from interruptions, and fully charged laptop or desktop with power backup. Log in to the test portal 10-15 minutes early to complete any pre-test verification procedures and avoid last-minute technical rushes.

During the 75-minute test, manage your time strategically.

Spend the first pass (approximately 40-45 minutes) answering all questions you’re confident about, marking uncertain questions for review. This ensures you capture all “easy” marks before time pressure builds. Use the second pass (approximately 20-25 minutes) to tackle marked questions, applying elimination techniques for multiple choice options and making educated guesses. Use the final 10 minutes for a quick review to catch any obvious errors or questions you might have accidentally skipped.

Remember there’s no negative marking, so ensure you’ve attempted all 50 questions before submitting—even a guess has a 25% chance of being correct in a four-option multiple choice question.

What happens if you don’t pass?

If you don’t pass the proficiency test on your first attempt, you can reattempt the test after a 1-day gap, meaning if you took the test on Monday and didn’t pass, you can reattempt on Wednesday or any day thereafter. There is no limit on the number of attempts you can make, so you can keep retaking the test until you pass, provided you stay within the 2-year deadline from your databank registration date.

After each attempt, you’ll receive your result immediately on the test portal showing your score out of 100 and whether you passed (50% or higher) or didn’t pass. Review which sections you performed poorly in—the result typically breaks down your performance across the four subject areas (company law, securities law, accounting, governance). Focus your re-preparation on weak areas before reattempting rather than studying everything again from scratch.

If you’re approaching the 2-year deadline without having passed, you can request a 1-year extension by paying a fee of ₹1,000 + GST as per the Companies (Appointment and Qualification) Second Amendment Rules 2022. This extension gives you an additional year to clear the test, but it’s better to avoid this situation entirely by starting your test preparation early rather than procrastinating until the deadline approaches.

Most candidates pass within their first 2-3 attempts if they’ve properly studied the IICA eLearning modules and taken mock tests seriously before attempting the actual examination.

If you want to know in details about Independent Director Exam then read my another article here.

How to secure your first board appointment

Understanding how companies find independent directors

When a company needs to appoint an independent director, their Nomination and Remuneration Committee (NRC) typically initiates a search on the IICA databank portal. Companies have registered access to the databank after paying subscription fees, and they can search using multiple filters: expertise areas, industry experience, location, age range, professional qualifications, and keywords. For example, a pharmaceutical company might search for “pharma industry experience + regulatory affairs expertise + located in Mumbai + 55-65 age range.”

Your profile’s visibility depends on how well your information matches company search criteria. If you’ve thoroughly filled out your expertise areas, industry experience, and professional background with relevant keywords, you’ll appear in more searches. Conversely, a sparse profile with minimal information reduces your discoverability dramatically. Companies can view detailed profiles of candidates matching their criteria, download comprehensive information, and contact candidates directly using the email and mobile number provided in the databank, which facilitates the initial conversation about potential board opportunities.

According to IIMB research (accessed on Oct 2025), India currently needs approximately 30,000 independent directors, with this demand expected to double to 60,000 by 2030 as more companies list on stock exchanges and regulatory requirements expand.

This growing demand creates opportunities, but competition is also increasing as more professionals pursue independent director roles post-retirement or as portfolio careers. Understanding what makes your profile attractive to companies helps you stand out in this expanding marketplace.

Active strategies to get noticed

Networking through IICA programs and events

IICA regularly conducts webinars, masterclasses, and capacity-building programs for independent directors. Participate actively in these events—they serve dual purposes of enhancing your knowledge and expanding your professional network. These programs often feature senior corporate leaders, regulators, and experienced independent directors as speakers. Engaging in Q&A sessions, introducing yourself in networking segments, and following up after events creates visibility beyond just your databank profile.

Don’t be passive in these programs—ask thoughtful questions that showcase your expertise, share relevant experiences from your professional background when appropriate discussions arise, exchange contact information with fellow participants who might have board connections, and follow up with speakers or interesting contacts via LinkedIn or email after the event. Building genuine relationships through repeated participation in multiple IICA events over time increases the likelihood of someone in your network thinking of you when a board opportunity arises in your area of expertise.

Leveraging professional networks and executive search firms

Your existing professional network is often the most powerful resource for securing board opportunities. Inform current and former employers, clients, business contacts, and industry peers that you’re qualified and available for independent director positions. Many board appointments happen through referrals—someone on an existing board recommends a candidate they know and trust, and the NRC invites that person for an interview rather than conducting a cold search through the databank.

Executive search firms specializing in board-level placements represent another important channel. Major firms recruiting independent directors include Korn Ferry, Heidrick & Struggles, Egon Zehnder, Spencer Stuart, and Russell Reynolds, along with boutique firms specializing in independent director searches. Research which firms are active in your target industries and reach out to introduce yourself, providing your professional resume and highlighting your governance readiness. While these firms primarily work on behalf of companies rather than candidates, having your profile in their databases increases the chances of being considered when relevant mandates arise.

Direct outreach to target companies

Identify companies in industries where you have deep expertise and research their current board composition using publicly available information. Listed companies disclose board details in annual reports and on their websites, and you can identify potential vacancies by looking for directors approaching retirement age, boards with fewer independent directors than peers in the same sector, or companies recently listed that might be building out their governance structures.

Once you’ve identified target companies, reach out directly to the Company Secretary or Nomination and Remuneration Committee members (their contact information is typically available on company websites under investor relations sections). Craft a concise, professional expression of interest highlighting your relevant expertise, governance qualifications (DIN, databank registration, proficiency test completion), and specific value you could bring to their board given their industry and strategic challenges. While success rates for cold outreach are lower than referrals, it demonstrates proactive interest and might place you on the company’s radar for future board openings even if current timing doesn’t align.

Building competitive advantage

Optional certifications (IICA, ICSI, LawSikho)

Beyond the mandatory IICA proficiency test, several institutions offer certification programs that can enhance your competitiveness.

ICSI (Institute of Company Secretaries of India) offers governance certifications with deep legal and compliance focus, particularly valuable if you’re targeting finance, banking, or heavily regulated sectors.

KPMG’s Independent Director Certification Programme is a 50+ hour virtual classroom program covering 18 modules from governance frameworks to ESG, cyber security, and digital transformation.

LawSikho Independent Director’s Professional Development Program provides flexible online programs suitable for working and retired professionals who want to build governance knowledge without intensive time commitments.

These premium programs typically cost ₹2,50,000 to ₹5,00,000+ depending on the institution and program duration, representing a significant investment beyond the mandatory ₹5,900-₹29,500 IICA databank subscription.

However, they’re supplementary—you cannot skip the mandatory IICA databank registration and proficiency test by taking a premium certification instead. To know more about the certification courses read my article on Independent Director Course.

How to become an independent director: the appointment process

Company selection and interview process

Nomination and remuneration committee screening

The appointment process typically begins with the company’s Nomination and Remuneration Committee (NRC), a board sub-committee established under Section 178 of the Companies Act 2013 that identifies, evaluates, and recommends independent director candidates.

If your databank profile matches the company’s needs, the NRC will shortlist you along with other candidates and initiate preliminary screening through your profile review, background verification of your professional credentials and reputation, and checking for potential conflicts of interest or disqualifications.

The NRC conducts initial interviews, either in-person or via video conference, to assess your fit with the company’s industry, strategic needs, and board culture. Prepare for these interviews as you would for senior executive positions—research the company thoroughly including its business model, financial performance, competitive positioning, governance structure, and recent strategic initiatives. Understand the company’s specific challenges in your expertise area and be ready to articulate how your background equips you to provide valuable oversight and guidance.

During NRC interviews, expect questions about your understanding of independent director duties, your availability for board and committee meetings, your perspective on the company’s strategic direction and risks, how you would handle conflicts between management and board, and specific expertise you bring relevant to the company’s industry or challenges. The NRC assesses not just your technical qualifications but also your judgment, communication style, and whether you’ll be an effective contributor to board deliberations rather than simply a rubber-stamp director.

Board approval and shareholder resolution

After NRC recommendation, the full board of directors must approve your proposed appointment. The board reviews the NRC’s recommendation, examines your profile and credentials, considers whether you meet all independence criteria under Section 149(6) of the Companies Act 2013, and passes a board resolution approving your appointment subject to shareholder approval. The board resolution specifies your proposed tenure (typically 5 years for the first term), remuneration structure including sitting fees and commission, committee assignments, and other terms and conditions.

The company must then obtain shareholder approval at the next Annual General Meeting (AGM) or convene an Extraordinary General Meeting (EGM) specifically for your appointment. The company prepares an explanatory statement justifying your appointment and describing your qualifications, experience, expertise, and why you’re suitable as an independent director as per Section 102 of the Companies Act 2013. This transparency enables shareholders to make informed voting decisions.

Shareholders vote on your appointment through an ordinary resolution requiring a simple majority of votes cast. For listed companies, institutional investors often scrutinize independent director appointments carefully, assessing whether candidates truly bring independent judgment and relevant expertise to the board. Once shareholders approve your appointment, it becomes effective from the date specified in the resolution, though several documentation and filing requirements must still be completed before you can formally assume your directorship role.

Documentation required from you

Form DIR-2 (Consent to act as director)

You must file Form DIR-2, which is your consent to act as director, confirming you accept the appointment and are not disqualified under any provision of the Companies Act 2013. This form requires your DIN, details of other directorships you hold to verify you’re not exceeding directorship limits under Section 165, and a declaration that you meet all eligibility criteria. Form DIR-2 must be filed before the board meeting at which your appointment is considered—it’s a prerequisite for the board to validly appoint you.

The form includes sections where you declare that you’re not disqualified under Section 164, haven’t been convicted of any offence resulting in disqualification, aren’t an undischarged insolvent, and haven’t been a director of any company that failed to file financial statements or annual returns for three continuous financial years or defaulted on deposit repayment, debenture redemption, or dividend payment for over one year. Providing false information in Form DIR-2 can result in penalties and disqualification, so ensure complete accuracy before submission.

Section 149(7) declaration of independence

Section 149(7) of the Companies Act 2013 requires you to give a written declaration to the company confirming that you meet all criteria for independence specified in Section 149(6). This is a formal letter on plain paper declaring that you have no disqualifying relationships, financial interests, or other conflicts that would compromise your independence. The declaration explicitly states that you’re not a promoter or related to promoters/directors, have no material pecuniary relationship with the company exceeding thresholds, don’t hold 2% or more shareholding, haven’t been a KMP/employee in the last three years, and aren’t partner/proprietor/employee of service provider firms within cooling-off periods.

Yo wi’ll need to provide this declaration at the first board meeting you attend after appointment and thereafter at the first meeting of every financial year. This annual renewal ensures ongoing compliance with independence criteria throughout your tenure. If circumstances change during your tenure—for example, you acquire shares in the company, enter a financial relationship, or your relative takes a position that creates potential conflicts—you must disclose this to the board as early as possible, which could affect your status as an independent director and require you to step down if independence criteria are no longer met.

Form DIR-8—Declaration of non-disqualification

Form DIR-8 is the declaration submitted by the proposed director confirming that none of the disqualifications specified in Section 164 apply to them. It confirms that the individual has not been convicted of offences involving moral turpitude or fraud, is not under disqualification by any court or tribunal, and has not defaulted on statutory filings or repayments. The form is submitted to the company prior to the board meeting at which the appointment is considered and is maintained as part of the company’s internal records. It is attached to Form DIR-12 at the time of filing the appointment with the Registrar.

Form MBP-1 (Disclosure of interests)

Under Section 184 of the Companies Act 2013, every director must disclose their interests in other entities to the company. Form MBP-1 is the disclosure form where you list all companies, Limited Liability Partnerships (LLPs), firms, and other entities in which you’re a director, partner, member, or hold substantial interest (more than 2% shareholding). This disclosure enables the company to identify potential conflicts of interest when board decisions involve entities you’re associated with.

You must file Form MBP-1 at your first board meeting after appointment and update it within 30 days whenever your interests change—if you join a new board, acquire shares in another company, or your association with any entity changes. The company maintains a register of directors’ interests based on these disclosures, and you must recuse yourself from board discussions and voting on matters where you have a disclosed interest to avoid conflicts. Failure to properly disclose interests or participating in conflicted transactions can result in penalties under Section 184 and potential removal from the board.

Form B—Insider trading disclosure for listed companies

Form B, prescribed under Regulation 7(1)(b) of the SEBI (Prohibition of Insider Trading) Regulations, 2015, is the initial disclosure of securities holdings that every director, key managerial personnel, and promoter must provide upon appointment. It is submitted within seven days of assuming office to the company’s compliance officer. The disclosure covers any holdings in equity shares, debentures, warrants, or other securities of the company. Independent directors generally do not hold securities, but even in such cases, a nil disclosure must be filed to establish the baseline shareholding from which future trading disclosures will be monitored.

MCA filing and official appointment

Company files form DIR-12 within 30 Days

The company must file Form DIR-12 (notice of appointment of director) with the Ministry of Corporate Affairs within 30 days of your appointment as per Section 170 of the Companies Act 2013 read with Rule 18 of the Companies (Appointment and Qualification of Directors) Rules 2014. This form notifies the Registrar of Companies that you’ve been appointed as a director of the company, effective from the specified date. Form DIR-12 includes your DIN, appointment date, designation (independent director), and attaches copies of the board resolution and shareholder resolution approving your appointment.

Once the MCA processes DIR-12, your directorship is officially recorded in the MCA database and appears in the company’s public records. This typically updates within 2-3 days of DIR-12 approval. You can verify successful filing by checking your DIN profile on the MCA portal—your new directorship should appear in the “List of Directorships” section. If the company delays filing DIR-12 beyond the 30-day deadline, it attracts late filing fees and potential penalties, though this compliance obligation rests with the company rather than you personally.

Receiving your formal appointment letter

Shortly after shareholder approval, the company will issue a formal appointment letter outlining the terms and conditions of your directorship. This is a legal requirement under Schedule IV of the Companies Act 2013, which contains the Code for Independent Directors. The appointment letter specifies your tenure period (5 years for the first term), roles and responsibilities you’ll undertake as an independent director, board committees you’ll serve on (such as Audit Committee, Nomination and Remuneration Committee, or Stakeholder Relationship Committee), and the code of conduct you’re expected to follow as per Schedule IV.

The letter details your remuneration including sitting fees per board meeting (typically ₹20,000 to ₹1,00,000 depending on company size), sitting fees for committee meetings, annual commission based on company profits (if applicable), reimbursement policies for travel and expenses, and insurance coverage such as Directors and Officers (D&O) liability insurance.

The letter also clarifies performance evaluation procedures, circumstances under which your appointment could be terminated, confidentiality obligations, and disclosure requirements you must maintain throughout your tenure as an independent director.

What happens after the appointment?

Initial board meeting obligations

At your first board meeting after appointment, you must formally provide your Section 149(7) declaration of independence to the company. You’ll also need to familiarize yourself with the company’s articles of association, memorandum of association, governance policies, code of conduct for directors, recent board minutes to understand ongoing discussions and decisions, committee charters for committees you’re assigned to, and the company’s current strategic plan and key challenges. Many companies provide an onboarding session for new independent directors covering company operations, financial performance, regulatory compliance status, risk management framework, and introductions to key management personnel.

You’re expected to attend board meetings regularly—companies typically hold at least four board meetings annually as mandated by Section 173 of the Companies Act 2013 and SEBI LODR Regulation 17. Board materials are usually circulated 5-7 days before meetings, and you should review them thoroughly, prepare questions, identify areas requiring deeper scrutiny, and come prepared to contribute meaningfully to discussions rather than being a passive attendee. Your role is to ask probing questions, challenge assumptions when appropriate, ensure management proposals align with stakeholder interests, and provide independent perspective that executive directors might miss due to their operational involvement.

Annual DIR-3 KYC filing requirement

Every director holding a DIN must file e-Form DIR-3 KYC annually by September 30th as per rule 12A of the Companies (Appointment and Qualification of Director) Rules 2014. This requirement applies to all directors whose DIN status is “Approved” as of March 31st of that financial year. The KYC form updates your current contact information, address, and other personal details in the MCA database, ensuring the government maintains accurate records of all directors.

If you fail to file DIR-3 KYC by the September 30th deadline, the MCA will mark your DIN as “Deactivated due to Non-filing of DIR-3 KYC.”

Once deactivated, you will not be able to sign any document and file it with MCA until you reactivate your DIN by filing the pending KYC form along with a late fee of ₹5,000.

Therefore, mark September 30th in your calendar every year and file your KYC even if your personal details haven’t changed—this is a simple compliance requirement that takes only 10-15 minutes but has severe consequences if missed.

Conclusion

Becoming an independent director in India is a systematic process requiring three core steps:

- obtaining your Director Identification Number (DIN),

- registering with the IICA Independent Directors Databank, and

- passing the proficiency test (unless you qualify for exemption).

The entire journey typically takes 6-12 weeks to become appointment-ready, with total investment ranging from ₹7,400 to ₹32,000 depending on your subscription choices and whether you engage professional assistance for DIN application.

The growing demand for independent directors which is going to double by 2030 from 30,000 currently, creates significant opportunities for qualified professionals. Success requires not just meeting regulatory requirements but also strategic positioning through networking, profile optimization, and potentially premium certifications that enhance your competitive advantage.

As you embark on this journey, remember that independence is not merely a technical checklist but a fundamental mindset of objective judgment, stakeholder protection, and ethical oversight that forms the foundation of effective corporate governance.

Your contributions as an independent director will shape India’s corporate landscape and help build transparent, accountable organizations that serve all stakeholders responsibly.

Frequently Asked Questions

How much does it cost to become an independent director?

The total cost ranges from ₹7,400 to ₹35,000 including GST. You’ll pay ₹500 for DIN application, ₹1,000-₹2,000 for Digital Signature Certificate, and ₹5,900 for 1-year IICA databank subscription (₹17,700 for 5-year or ₹29,500 for lifetime). Optional professional fees for CA/CS assistance with DIN application add ₹1,000-₹5,000.

How long does the entire process take?

Becoming appointment-ready typically takes 6-12 weeks. Week 1-2 covers DIN application and approval. Week 2 involves IICA databank registration (can overlap with DIN processing). Weeks 2-6 include proficiency test preparation and passing. After completing these steps, the timeline for securing your first board opportunity varies from weeks to months depending on your network, expertise, and market demand.

Can I become an independent director without a commerce degree?

Yes, the Companies Act 2013 doesn’t mandate specific educational qualifications. What matters is having appropriate skills, experience, and knowledge in relevant fields. Engineers, scientists, doctors, and professionals from any field can become independent directors if they have expertise valuable to the company’s business—technology companies seek engineers, pharmaceutical companies want doctors and scientists, and infrastructure companies need civil engineers.

What are the challenges faced by Independent Directors in enforcing corporate governance?

Independent Directors often face structural and practical hurdles in enforcing good governance. The biggest challenge lies in information asymmetry—management controls access to key data, limiting directors’ ability to make fully informed judgments. There’s also subtle pressure to conform to promoter or executive interests, especially in promoter-driven companies where independence can be perceived as dissent. Time constraints, inadequate boardroom transparency, and limited access to independent advisors further weaken their oversight role. To know more read this article on challenges faced by Independent Directors.

Do I need to be in India to complete the process?

No, foreign nationals and NRIs can complete the entire process remotely. You’ll use your passport for DIN application instead of PAN/Aadhaar, and the IICA databank registration accepts foreign addresses and mobile numbers. The proficiency test is available online globally. However, nationals from countries sharing land borders with India require security clearance from the Ministry of Home Affairs before DIN allotment.

How many attempts do I get for the proficiency test?

There’s no limit on attempts—you can retake the proficiency test until you pass, with only a 1-day gap required between attempts. However, you must pass within 2 years from your databank registration date, or your name will be removed from the databank. If approaching the deadline, you can request a 1-year extension by paying ₹1,000 + GST under the Companies (Appointment and Qualification) Second Amendment Rules 2022.

What happens if I don’t pass within 2 years?

Your name will be removed from the Independent Directors Databank if you fail to pass within 2 years of registration. You can get a 1-year extension to pass the test by paying ₹1,000 + GST. If removed, you’ll need to re-register and pay subscription fees again to regain databank access, wasting both time and money—so treat the 2-year deadline seriously.

Can I serve on multiple boards simultaneously?

Yes, you can serve as an independent director in up to 7 listed companies simultaneously under Section 165 of the Companies Act 2013 and SEBI LODR Regulation 17A. If you’re a whole-time director in any listed company, your independent directorship limit reduces to 3 listed companies. For unlisted companies, there’s no specific independent director limit beyond the general 20-company total directorship cap.

Is the proficiency test difficult to pass?

The test has moderate difficulty with a 50% passing threshold (25 out of 50 questions correct) and no negative marking. Candidates with legal or commerce backgrounds find it easier as the content covers familiar territory like Companies Act 2013 and SEBI regulations. Those from non-commerce backgrounds need 30-40 hours of preparation using the 40+ IICA eLearning modules and mock tests to pass comfortably.

Can practicing professionals (CA/CS) become independent directors?

Yes, practicing Chartered Accountants, Company Secretaries, and Advocates can become independent directors and are highly sought after. If you’ve practiced for 10+ years, you’re exempt from the proficiency test under Rule 6 of the Companies (Appointment and Qualification of Directors) Rules 2014. However, you cannot be an independent director in companies where you provide professional services—this prevents conflicts of interest.

How do companies find me after I register?

Companies search the IICA databank using filters like expertise areas, industry experience, location, age range, and qualifications. They contact you via the email address and mobile number in your profile. Optimizing your profile with relevant keywords in experience descriptions and selecting appropriate expertise areas increases your visibility in company searches.

What is the difference between DIN and databank registration?

DIN (Director Identification Number) is a unique 8-digit identifier required for anyone serving as director in any company, obtained from the Ministry of Corporate Affairs via Form DIR-3. Databank registration is specifically for independent directors, maintained by IICA, where companies search for independent director candidates. You need both—DIN first, then databank registration using your DIN.

Can foreign nationals become independent directors?

Yes, foreign nationals can serve as independent directors in Indian companies per the Companies Act 2013. You’ll use your passport for DIN application and provide foreign address in databank registration. However, nationals from countries sharing land borders with India (Pakistan, Bangladesh, China, Nepal, Myanmar, Afghanistan, Bhutan) must obtain security clearance from the Ministry of Home Affairs before DIN allotment.

Do I need to renew my DIN annually?

Your DIN has lifetime validity and never expires. However, you must file Form DIR-3 KYC annually by September 30th to keep it active as per Rule 12A of the Companies (Appointment and Qualification of Directors) Rules 2014. Failure to file attracts ₹5,000 penalty and DIN deactivation, preventing you from serving as director in any company until you file pending KYC and pay the penalty.

What happens after my databank profile is complete?

After completing your IICA databank profile and paying subscription fees, you become visible to companies searching for independent director candidates. You should pass the proficiency test within 2 years, actively network through IICA programs, optimize your profile with relevant keywords, leverage executive search firms, and inform your professional network of your availability for board opportunities.

How long should I expect to wait for board opportunities?

Timeline varies significantly—some receive inquiries within weeks while others wait 6-12 months or longer. Factors affecting timeline include your industry expertise (high-demand sectors like technology and finance move faster), professional network strength (referrals accelerate opportunities), location (metro cities have more listings), profile optimization quality, and active networking efforts. Current market data from IIMB shows demand for 30,000+ independent directors which is going to double by 2030, creating expanding opportunities for qualified professionals.

Allow notifications

Allow notifications