Complete guide to appointment of independent directors under the Companies Act 2013 & SEBI LODR. Step-by-step procedure, forms, SEBI 2022 amendments, timelines, FAQs.

Table of Contents

Imagine stepping into a boardroom where you’re valued not simply for ticking a regulatory box but because your experience, your insight and your strategic voice matter.

With India’s listed companies still expanding and governance expectations rising, the call for credible independent directors is becoming louder. In fact, median remuneration for independent directors at top firms has more than doubled from 2019 to 2024—rising from around ₹ 42.3 lakh in FY19 to ₹ 87.4 lakh in FY24.

If you’re a senior legal advisor, a former government official, a Lawyer/CS/CA in transition or a student aspiring to board-level influence, now is the moment to learn everything about the Independent Director.

This guide provides a comprehensive overview of the appointment of independent directors under the Companies Act, 2013 and the SEBI LODR Regulations.

I’ll cover the complete lifecycle—from figuring out if a company even needs independent directors, through the step-by-step appointment procedure, to post-appointment compliance obligations that many overlook.

By the end of this guide, you’ll know everything that is to know about appointment of independent directors.

Which companies need to appoint independent directors?

Before diving into the appointment procedure, you need to know whether the company is legally required to have independent directors on its board.

The Companies Act, 2013 and SEBI LODR Regulations create different requirements for listed companies, unlisted public companies meeting certain thresholds, and various exemptions.

Accurately determining whether independent directors are required is crucial. An unnecessary appointment creates additional compliance obligations, while failing to appoint when required can result in regulatory non-compliance and penalties.

Listed public companies

If a company’s shares are listed on any recognized stock exchange in India, that company is subject to the strictest independent director requirements.

Section 149(4) of the Companies Act, 2013 mandates that every listed public company must have at least one-third of its total directors as independent directors.

For example, a company with nine directors must appoint at least three independent directors to meet the one-third requirement Any fraction in that one-third calculation gets rounded up to one. In the case of a ten-member board, the fraction (3.33) is rounded up to four independent directors as per Rule 4. This rounding rule under Rule 4 ensures that the independent director presence is meaningful, not minimal. For listed companies, this requirement applies regardless of your company’s financial size—even a small-cap listed company with modest revenues must comply with the one-third threshold.

But compliance doesn’t stop there.

Regulation 17 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 strengthens these standards for listed entities. It requires that:

- At least 50% of the board must comprise non-executive directors.

- Where the chairperson is a non-executive director, at least one-third of the board must be independent directors.

- If the listed entity does not have a regular non-executive chairperson, or if the non-executive chairperson is a promoter or related to any promoter or member of management, then at least half of the board must consist of independent directors.

- The top 500 and top 1,000 listed entities (by market capitalisation) must have at least one independent woman director (by 1 April 2019 and 1 April 2020, respectively).

- The top 1,000 and top 2,000 listed companies must have a minimum of six directors on the board.

- And no non-executive director aged 75 years or above can be appointed or continue unless shareholders approve it by a special resolution with justification.

Together, the Companies Act and SEBI LODR framework make it clear that listed companies must maintain a well-balanced, diverse, and independent board, ensuring real oversight rather than symbolic compliance.

Unlisted public companies

For unlisted public companies, the requirement isn’t universal—it kicks in when a company cross specific financial thresholds.

Rule 4 Companies (Appointment and Qualification of Directors) Rules, 2014 specifies three alternative triggers, and meeting any one of them makes independent directors mandatory. A company will need at least two independent directors on your board if your company meets any of these criteria as on the last date of your latest audited financial statements.

- The first threshold is paid-up share capital of ₹10 crore or more. This is your company’s actual capital received from shareholders, shown in your balance sheet under equity.

- The second threshold is annual turnover of ₹100 crore or more, which you’ll find in your profit and loss statement as total revenue from operations.

- The third threshold is outstanding loans, debentures, and deposits aggregating to ₹50 crore or more—this is the sum of your company’s borrowings from financial institutions, public deposits accepted, and debentures issued, all shown on the liabilities side of your balance sheet.

These thresholds are assessed based on company’s last audited financial statements.

If a company’s turnover exceeds ₹100 crore in FY 2023-24 and the audit concludes in June 2024, the requirement to appoint independent directors arises thereafter. Many companies overlook this transition point, underscoring the need for regular monitoring of these thresholds.

There’s also an important compliance nuance: if an unlisted public company needs more than two independent directors to properly constitute audit committee (which requires at least one independent director under Section 177), you must appoint the higher number. So even though the baseline is two independent directors, the actual requirement might be three or four depending on the audit committee structure and whether it’s composed entirely of independent directors or includes non-executive non-independent directors.

Exemption for unlisted public companies

Even if a unlisted public company meets the financial thresholds, three categories of companies get a complete pass on independent director requirements under Rule 4(2) of Companies (Appointment and Qualification of Directors) Rules, 2014.

- The first exemption covers joint venture companies—if your company is established as a joint venture with specified ownership structures, you’re exempt.

- The second exemption applies to wholly-owned subsidiaries where 100% of the equity is held by a holding company.

- The third exemption is for dormant companies that have ceased operations and maintain minimal activity only to preserve their corporate existence.

These exemptions make practical sense—joint ventures often have balanced board representation from multiple partners serving the watchdog function that independent directors would provide, while wholly-owned subsidiaries are effectively governed through the holding company’s board. Dormant companies don’t engage in business activities that would justify the expense and effort of appointing independent directors.

However, if a company falls out of these categories—say, a wholly-owned subsidiary that’s partially divested—the company lose the exemption immediately and must appoint independent directors within the statutory timelines.

What are the key legal provisions governing the appointment of independent directors?

Understanding the legal framework is essential because independent director appointments are governed by multiple overlapping statutes—the Companies Act, 2013, the Companies (Appointment and Qualification of Directors) Rules 2014, and for listed companies, SEBI LODR Regulations.

Each layer adds specific requirements, and a company needs to comply with the most stringent provisions applicable to a company type.

What makes this particularly tricky is that the Companies Act and SEBI regulations don’t always align perfectly, creating situations where a company need to navigate carefully to satisfy both frameworks.

Section 149 of companies act, 2013

Section 149 is the foundational provision that defines independent directors, establishes qualification criteria, and sets tenure rules.

Subsection (6) provides the basic definition—an independent director is a non-executive director who, in the opinion of the board, is a person of integrity and possesses relevant expertise and experience. But the real teeth are in the sub clauses of subsection (6), which lists detailed independence criteria:

- the director cannot be or have been a promoter,

- cannot have pecuniary relationships with the company exceeding specified thresholds,

- cannot have been a key managerial personnel in the preceding three years, and

- cannot hold more than 2% voting power in the company.

These aren’t guidelines—they’re disqualification criteria, and failing any one of them means the person simply cannot be appointed as an independent director. To know in detail about the disqualification criteria, read my another article here.

Subsection (7) creates an ongoing obligation that many companies overlook. The obligation stipulates that every independent director must give a declaration of independence at the first board meeting they attend as a director, and then annually at the first board meeting of each financial year.

If circumstances change affecting their independencethey must immediately inform the board. This isn’t a one-time check; it’s continuous verification.

Subsections (10) and (11) govern tenure: an independent director can serve for up to five consecutive years and can be reappointed for one more term of up to five years, but no independent director can serve more than two consecutive terms. After completing two terms (which could be 10 years if both terms are full five-year terms), there’s a mandatory three-year cooling-off period during which the person cannot be associated with the company in any capacity, directly or indirectly. Only after this cooling-off can they potentially be reappointed.

Rules 4 to 6 of companies (appointment and qualification of directors) rules, 2014

The Companies (Appointment and Qualification of Directors) Rules, 2014 (hereinafter as ‘the Appointment Rules’) translate Section 149‘s principles into specific procedural requirements.

Rule 4 specifies which classes of companies must appoint independent directors—we covered that above, but Rule 4 also addresses important procedural points like vacancy filling timelines (intermittent vacancies must be filled at the earliest but not later than the immediate next board meeting or three months from vacancy, whichever is later).

Rule 5 elaborates on qualification criteria, particularly around expertise requirements—the independent director should possess skills, experience, and knowledge in fields like finance, law, management, sales, marketing, administration, research, corporate governance, or technical operations related to the company’s business. This isn’t about having formal qualifications necessarily, but demonstrable experience and expertise. Rule 5 also specifies the disqualification criteria similar to Section 149(6) of the Companies Act.

Rule 6 is entirely devoted to the Independent Directors’ Databank maintained by the Indian Institute of Corporate Affairs (IICA). It mandates that every person appointed as an independent director, or intending to be appointed, must apply to IICA for inclusion in the databank. Rule 6(4) creates the proficiency test requirement: every individual in the databank must pass an online proficiency self-assessment test conducted by IICA within two years of their name being added to the databank, failing which their name will be removed.

However, the rule also specifies exemptions—if you’ve served as a director or KMP for at least three years in specified companies (listed companies, unlisted public companies with ₹10 crore paid-up capital, etc.), you’re exempt.

Similarly, professionals like chartered accountants, company secretaries, cost accountants, and advocates with at least 10 years of practice are exempt from the test.

SEBI LODR Regulation 25

For listed companies, SEBI’s Listing Obligations and Disclosure Requirements (LODR) Regulations, 2015 add another critical layer to how independent directors are appointed and governed.

Regulation 25(2A) requires that every appointment, reappointment, or removal of an independent director be approved by shareholders through a special resolution.

Following SEBI’s November 2022 amendment, even if a special resolution fails to secure 75 percent approval, the appointment can still be deemed approved if

(a) votes in favour exceed votes against overall, and

(b) public shareholders’ votes in favour exceed their votes against.

Once appointed, Regulation 25(7) mandates that listed entities conduct structured familiarisation programmes covering the nature of the industry, business model, and the roles, rights, and responsibilities of independent directors. Details—number of programmes, directors trained, and hours spent—must be disclosed on the company website.

In addition, Regulations 25(8) and (9) require every independent director to submit a formal declaration of independence at the first board meeting after appointment and annually thereafter, and the board must record and verify these declarations. This is requirement is similar to Section 149(7) of the Companies Act.

SEBI LODR Regulation 25(2A)

Why SEBI introduced the november 2022 amendment

SEBI’s November 2022 amendment to Regulation 25(2A) addressed a critical governance concern that had emerged in practice. Prior to this amendment, the appointment or removal of independent directors in listed companies required shareholder approval through a special resolution—meaning 75% of votes cast needed to be in favor. This created a situation where controlling shareholders or promoters holding more than 25% could unilaterally block independent director appointments they didn’t favor, even if a majority of shareholders supported the appointment.

The Primary Market Advisory Committee (PMAC) recommended that SEBI review this process to enhance minority shareholder protection and reduce promoter blocking power. The amendment was effective from November 15, 2022, per the SEBI (Listing Obligations and Disclosure Requirements) (Sixth Amendment) Regulations, 2022 notification.

How the alternative approval mechanism prevents promoter blocking

Under the alternative approval mechanism, if a special resolution for appointing an independent director fails to achieve the 75% threshold but meets two other conditions, the appointment is still deemed approved. First, the votes cast in favor must exceed the votes cast against—this is essentially an ordinary resolution standard where a simple majority suffices. Second, the votes cast by public shareholders (non-promoters) in favor must exceed votes cast by public shareholders against the resolution.

This dual-threshold test means promoters can no longer unilaterally block independent director appointments by withholding their votes. If public shareholders—the minority shareholders the independent directors are meant to protect—vote in favor, and overall there are more votes for than against, the appointment succeeds even without promoter support. It fundamentally shifts power dynamics in favor of minority protection.

How it enhances minority shareholder protection

The amendment recognizes that independent directors serve primarily to safeguard minority shareholder interests and maintain governance standards. By ensuring that public shareholders’ voting preferences are explicitly considered and given decisive weight, the amendment makes it nearly impossible for promoters to install “independent” directors who lack genuine support from the shareholders they’re meant to protect. The requirement that public shareholder votes in favor must exceed public shareholder votes against creates a direct minority shareholder veto power—if minority shareholders don’t want a particular person as an independent director, they can effectively block the appointment even if promoters support it.

This also addresses situations where promoters might try to appoint nominally independent directors who are actually aligned with promoter interests. Minority shareholders, through their voting, can signal whether they view the proposed director as genuinely independent and protective of their interests.

Comparison between SEBI Reg 25(2A) and companies act provisions

Here’s where it gets interesting: the Companies Act 2013 under Section 149(10) requires only an ordinary resolution for the first-term appointment of independent directors—simple majority approval is enough. However, for reappointment to a second term, Section 149(10) requires a special resolution.

SEBI’s pre-2022 position was stricter, requiring special resolutions for all appointments, reappointments, and removals of independent directors in listed companies.

The November 2022 amendment creates a middle ground.

Listed companies should draft resolutions for independent director appointments as special resolutions to comply with SEBI LODR requirements, but if the special resolution doesn’t achieve 75%, the alternative mechanism can save the appointment.

This means listed companies effectively have two pathways to valid appointment: the traditional special resolution route, or the alternative dual-threshold route. For reappointments, however, the special resolution requirement remains absolute under both Companies Act and SEBI regulations—there’s no alternative pathway for second-term appointments, which must secure 75% approval.

What are the pre-appointment requirements for an independent director?

Before a company can even begin the formal appointment procedure, there are critical prerequisites that the a proposed independent director must complete.

Under rule 6 of the the Companies (Appointment and Qualification of Director) Rules, 2014, a proposed independent director must register with the Independent Director Databank and pass the Proficieny Exam within 2 years of registration with databank, if not exempted.

Registration with the independent directors’ databank

Every person proposing to be an independent director must register with the Independent Directors’ Databank maintained by the Indian Institute of Corporate Affairs (IICA) under Section 150 of the Companies Act, 2013.

Like I said before, rule 6 explicitly states that companies may select qualified persons to be appointed as independent directors from this databank.

The registration process begins at the MCA portal where the individual uses their Director Identification Number (DIN), PAN, or passport to access the system.

After verifying their identity through OTP, they’re redirected to the IICA platform at independentdirectorsdatabank.in where they complete a detailed profile including educational qualifications, professional experience, current and past directorships, areas of expertise, and availability for board positions.

The databank registration comes with a fee structure:

- ₹5,000 plus 18% GST for a one-year subscription,

- ₹15,000 plus 18% GST for five years, or

- ₹25,000 plus 18% GST for lifetime registration.

Most professionals opting for independent director roles choose the five-year or lifetime options to avoid frequent renewals.

Once registered, the individual must keep their databank profile updated—any change in directorships, contact information, or qualifications must be reflected within 30 days. If you want to learn how to register with Independent Director Databank then read my article here.

Proficiency self-assessment test—process and exemptions

After registering with the databank, the individual must pass an online proficiency self-assessment test conducted by IICA—unless they qualify for an exemption.

The test covers essential topics for independent directors including

- Companies Act provisions,

- SEBI regulations,

- board procedures,

- roles and responsibilities,

- corporate governance principles,

- financial literacy,

- risk management frameworks and

- Case studies

The test format is straightforward: 50 questions, each carrying 2 marks, for a total of 100 marks. You need 50 marks (50% of total) to pass, meaning at least 25 correct answers. There’s no negative marking, and there’s no limit on the number of attempts you can make, though you must wait at least one day between attempts. Click here to learn in detail about the Proficieny Exam.

Exemptions from this test fall into two categories.

- First, if you’ve served for at least three years as a director or key managerial personnel (as of the date your name is added to the databank) in qualifying entities—listed public companies, unlisted public companies with ₹10 crore or more paid-up capital, bodies corporate incorporated outside India with at least US$ 2 million paid-up capital, statutory corporations under parliamentary or state legislation carrying on commercial activities, or in director-level positions in central or state government ministries—you’re exempt.

- Second, if you’re a professional with at least 10 years of practice as a chartered accountant, company secretary, cost accountant, or advocate, you’re exempt from the test.

These exemptions recognize that experienced directors and established professionals already possess the knowledge the test aims to verify. Use this checklist to see if you are exempt from the exam.

Timeline for databank registration and test completion

The critical deadline is Rule 6(4)’s two-year window: every individual whose name is included in the databank must pass the proficiency test within two years from the date their name was added, failing which their name will be removed from the databank.

If your name is removed for failure to pass the test, you cannot continue serving as an independent director. You can retake the test after your name is removed, pass it, and have your name re-added, but you’ll face a gap in your independent director status during that period.

A common question I get is whether someone must pass the proficiency test before being appointed as an independent director, or whether they can be appointed first and then complete the test later.

The MCA clarified that while databank registration should happen before appointment, the proficiency test can be completed within the two-year window after databank registration—you don’t need to pass the test before appointment as long as you’re committed to passing it within two years.

However, this creates risk: if a company appoints someone who then fails to pass the test within two years, their independent director status becomes invalid, creating a board composition compliance issue.

What is the step-by-step procedure to appoint an independent director?

Now we get to the heart of the matter—the actual procedure for appointing an independent director from start to finish.

This is not a single-step approval; it’s a carefully sequenced process involving multiple stakeholders, forms, meetings, and filings. Companies may stumble if they miss steps, file forms late, or get the resolution type wrong.

I’m going to walk you through all ten steps in the order they should happen, with specific attention to the forms, timelines, and approvals required at each stage. If you’re reading about independent director appointment for the first time, consider this your implementation checklist.

Step 1—Candidate identification and selection

The appointment process begins with identifying a suitable candidate who meets the independence criteria under Section 149(6) and possesses relevant expertise for your company’s needs.

The board of a company should assess what skills and experience gaps exist currently in their company—do they need:

- financial expertise for audit committee effectiveness?

- industry knowledge for strategic guidance?

- legal background for compliance oversight?

This skills matrix approach helps companies identify what type of independent director will add the most value. Caompanies can source candidates from the IICA databank, through professional networks, or via executive search firms specializing in board placements.

The key is ensuring the proposed candidate genuinely meets all independence criteria—no promoter relationships, no recent employment with the company, no substantial shareholding, no pecuniary relationships beyond permissible limits.

A company must identify a potential candidate, conduct preliminary due diligence to verify their directorship history, check for any disqualifications under Section 164, and confirm they don’t exceed the maximum directorship limits under Section 165. This upfront vetting prevents embarrassing situations of discovering disqualification issues after the formal appointment process has already initiated.

Step 2—Obtaining written consent and declarations from proposed director

Before a company can take the appointment proposal to their board or shareholders, a company needs four critical documents from the proposed independent director. These forms serve as the foundation for the appointment—without them, a company cannot proceed.

Form DIR-2—Consent to act as director

Form DIR-2 is the proposed director’s written consent to act as a director of a company. For independent directors specifically, Form DIR-2 should indicate that the person consents to appointment as an independent director, not just as a general director.

Form DIR-8—Declaration of non-disqualification

Form DIR-8 is a separate declaration specifically addressing disqualifications under Section 164. The proposed director confirms they haven’t been convicted of offenses involving moral turpitude, haven’t been found guilty of fraud or misfeasance, haven’t defaulted in repaying public deposits or debentures, haven’t been disqualified by a court or tribunal, and don’t have outstanding defaults in filing financial statements. This declaration must be provided to the company before the board meeting considering the appointment or reappointment—it’s a prerequisite for the board resolution.

Declaration of independence under section 149(7)

Beyond the standard director declarations, the proposed independent director must provide a specific declaration of independence meeting the criteria set out in Section 149(6). There is no specific format for this declaration. So, it can be in a simple letter format addressed to the board of directors of a company.

Form MBP-1—Disclosure of interest

Form MBP-1 is the director’s disclosure of interest in other entities, required under Section 184 of the Companies Act, 2013.

In this form, the director discloses all companies, firms, LLPs, or other bodies corporate in which they hold directorships, partnerships, memberships, or other interests. This allows the company to identify potential conflicts of interest where the director might need to recuse themselves from board discussions. The director must update this disclosure whenever their interests change—it’s an ongoing obligation, not a one-time filing.

Step 3—Nomination and remuneration committee (NRC) recommendation

If a company is required to constitute a Nomination and Remuneration Committee under Section 178 of the Companies Act, 2013—which applies to listed companies, public companies with paid-up capital of ₹10 crore or more, public companies with turnover of ₹100 crore or more, or public companies with outstanding loans/debentures/deposits exceeding ₹50 crore—the NRC must recommend the independent director appointment to the board.

The NRC’s role is to evaluate whether the proposed candidate possesses the requisite qualifications, experience, and expertise, and whether they meet the independence criteria. The NRC should also consider the balance of skills on the board and whether this appointment fills identified gaps.

The NRC documents its recommendation through a committee resolution or minutes noting that after evaluation, the committee recommends the board appoint [name] as an independent director for a term of [X] years, subject to shareholder approval.

This NRC recommendation then becomes part of the board agenda package. If a company doesn’t have an NRC (because it doesn’t meet the thresholds requiring one), the full board handles this evaluation directly in the board meeting considering the appointment.

Step 4—Board meeting to consider appointment

The appointment process formally begins with a board meeting, where directors consider and recommend the proposed independent director for shareholder approval. This stage doesn’t finalize the appointment—it simply reflects the board’s recommendation, which will later be placed before the shareholders.

Notice and agenda

Under Section 173(3) of the Companies Act and Secretarial Standard-1, every director must receive at least seven days’ notice of the board meeting. In urgent cases, a shorter notice is permissible.

The notice should clearly include the agenda item:

“To consider and approve the appointment of [name] as an Independent Director, subject to approval of members.”

Relevant documents—such as the proposed director’s resume, Forms DIR-2, DIR-8, MBP-1, declaration of independence, and NRC recommendation (if any)—should be attached to help directors make an informed decision.

Passing the board resolution

During the meeting, the board discusses the proposal and passes a resolution recommending the appointment of [name] as an independent director, subject to shareholder approval.

The resolution should:

- Specify the proposed term (up to five years under Section 149(10));

- Confirm compliance with independence criteria under Section 149(6); and

- Record that the explanatory statement for shareholders will include justification and relevant details.

This is a recommendation, not a final decision—the appointment takes effect only after shareholders’ approval.

Recording disclosure of interest

The proposed director must submit Form MBP-1, disclosing interests in other entities. The board should formally note this and maintain the form in the company’s records. Once appointed, the director must recuse themselves from discussions where any disclosed interest is involved.

Authorizing ROC filings

The board should authorize a specific officer—typically the Company Secretary, CFO, or a director—to file necessary forms with the Registrar of Companies (ROC), including Form DIR-12 (for appointment) and Form MGT-14 (if a special resolution is passed).

Fixing the general meeting

Finally, the board must fix the date, time, and venue (physical or virtual) for the general meeting where shareholders will vote on the appointment. This could be part of the Annual General Meeting (AGM) or a separate Extraordinary General Meeting (EGM). The notice period, typically 21 clear days, must be observed to maintain statutory compliance.

Step 5—Preparing notice for general meeting

After the board meeting approves the proposal, the company must prepare and send a formal notice to all shareholders convening the general meeting where they wll vote on the appointment.

Under Section 101, you must send this notice at least 21 days before the meeting date (unless it’s a shorter notice meeting with requisite consent, which is rare for independent director appointments). The notice must include a clear resolution for the appointment, and critically, it must include an explanatory statement under Section 102 justifying why the board recommends this appointment.

The explanatory statement should provide:

(a) a brief resume of the proposed independent director including their qualifications, experience, and expertise;

(b) details of their relationships, if any, with other directors, key managerial personnel, or promoters;

(c) information about their current and past directorships in listed and unlisted companies over the preceding three years;

(d) their shareholding in the company, if any;

(e) a statement confirming they meet all independence criteria under Section 149(6); and

(f) the terms and conditions of their appointment including the proposed tenure. This transparency allows shareholders to make informed voting decisions.

For listed companies, SEBI LODR Regulation 30 read with 51 requires disclosure of the board meeting outcome (including the proposal to recommend an independent director appointment) to stock exchanges within 24 hours of the board meeting conclusion. This pre-emptive disclosure means the market and shareholders are aware of the upcoming shareholder vote before they receive the formal notice.

Step 6—Shareholder approval in general meeting

The general meeting is where shareholders exercise their ultimate authority over the company’s board composition. The board’s recommendation becomes effective only after shareholder approval—without it, the appointment has no legal validity.

Type of resolution and approval thresholds

The type of resolution required depends on

(a) whether the company is listed or unlisted, and

(b) whether it is a first-term appointment or a reappointment for a second term.

Unlisted public companies:

An ordinary resolution (simple majority) is sufficient for the first-term appointment of an independent director under Section 149(10) of the Companies Act.

Listed companies:

Regulation 25(2A) of the SEBI (LODR) Regulations, 2015 governs appointments.

- Before November 2022, all appointments and reappointments required a special resolution (at least 75% approval).

- Post the November 2022 amendment, the process has become more flexible:

- The resolution should still be proposed as a special resolution; however,

- If it fails to achieve the 75% threshold, it can still be deemed approved through an alternative approval mechanism — that is:

- The resolution receives more votes for than against (i.e., ordinary resolution standard), and

- A majority of public shareholders vote in favor of the proposal.

- The resolution receives more votes for than against (i.e., ordinary resolution standard), and

- The resolution should still be proposed as a special resolution; however,

This mechanism ensures that independent directors can still be appointed even if promoter votes distort the special resolution outcome, provided the public shareholders largely support it.

Reappointment (Second Term)

For reappointment to a second consecutive term, both Section 149(10) of the Act and Regulation 25(2A) of the LODR explicitly require a special resolution—the alternative mechanism does not apply.

This higher threshold ensures that shareholders critically assess the director’s performance and independence before extending their tenure.

Conduct of the General Meeting

During the meeting, shareholders vote either by:

- Show of hands,

- Poll, or

- Electronic voting (e-voting)—mandatory for listed entities as per SEBI LODR and Section 108 of the Companies Act read with Rule 20 of the Companies (Management and Administration) Rules, 2014.

The Chairman then announces the results: whether the resolution was passed or defeated.

In listed companies where the special resolution fails but the alternative thresholds are met, the Chairman must separately declare that the appointment is approved under the alternative mechanism.

The Company Secretary records the proceedings in the minutes of the meeting, noting the exact vote counts (in case of poll or e-voting), the type of resolution passed, and the basis of approval (normal or alternative mechanism).

Step 7—Filing forms with registrar of companies (ROC)

Once shareholders approve the appointment, the company is required to inform the Registrar of Companies (ROC) by filing the prescribed forms within the statutory timelines. These filings officially record the appointment in the public domain and form part of the company’s mandatory compliance obligations.

Form DIR-12 — Notice of appointment

Form DIR-12 serves as a formal intimation to the ROC that an individual has been appointed as a director—in this case, an independent director (selected under the “director category” field).

This form must be filed within 30 days of the appointment.

- If the individual was first appointed as an additional director (to be regularized later), the 30-day period is calculated from the board resolution date.

- If the appointment was made directly by shareholders in a general meeting, the timeline runs from the date of the shareholder resolution—which is the standard process for independent directors.

Along with Form DIR-12, the company includes supporting documents such as:

- The board resolution and shareholder resolution approving the appointment,

- The proposed director’s consent (Form DIR-2),

- Declaration of non-disqualification (Form DIR-8), and

- Disclosure of interest (Form MBP-1).

The applicable filing fee depends on the company’s authorized share capital.

Form MGT-14 — Filing of special resolution (if applicable)

If the appointment was approved through a special resolution, the company must also file Form MGT-14 with the ROC within 30 days of the resolution being passed.

This requirement typically applies to:

- Listed company appointments made through the standard approval route, and

- Reappointments of independent directors in unlisted public companies.

Form MGT-14 is used to record special resolutions and other key decisions with the ROC. The company attaches the certified true copy of the special resolution along with the explanatory statement from the meeting notice.

Where the appointment has been approved through an ordinary resolution—for instance, the first-term appointment of an independent director in an unlisted company, or an appointment in a listed company under the alternative approval mechanism—filing of MGT-14 is not required. In such cases, only Form DIR-12 is filed.

Step 8—Time-bound disclosures for listed companies

Listed companies face additional disclosure obligations to stock exchanges and on their websites, with very tight timelines. These disclosures ensure market transparency and allow investors to immediately know about board composition changes. Missing these deadlines can result in SEBI penalties and listing compliance defaults, so corporate secretaries of listed companies must be particularly vigilant about these timelines.

Stock exchange disclosure within 24 hours of board meeting

Immediately after the board meeting concludes in which the board recommends the independent director appointment (subject to shareholder approval), you must disclose this outcome to all stock exchanges where your shares are listed. The timeline is within 24 hours from the conclusion of the board meeting, per Regulation 30 and 51 of SEBI LODR. The disclosure should state that the board has recommended the appointment of [name] as an independent director for a term of [X] years, subject to shareholder approval in the forthcoming general meeting.

This pre-notification serves several purposes: it prevents insider trading by making the information public immediately, it allows analysts and investors to evaluate the proposed director’s profile and form voting intentions, and it demonstrates the company’s commitment to transparency. The disclosure typically includes a brief resume of the proposed director so market participants can assess their qualifications.

Click here to see a sample letter.

Company website posting within 2 Days

Following the board meeting, the company should also publish the same information on its website.

While SEBI does not prescribe a specific “two-day” deadline, Regulation 46 of the SEBI (LODR) Regulations, 2015 requires listed entities to keep information regarding board composition and director appointments updated and accessible at all times.

Best practice is to post the disclosure within 24–48 hours of the board meeting. The information should remain available at least until the general meeting where shareholders vote on the appointment.

After shareholder approval, the website should be updated to reflect that the individual has been formally appointed as an independent director. Additionally, Regulation 46 requires companies to publish the terms and conditions of appointment of independent directors and keep them displayed throughout their tenure.

General meeting proceedings disclosure within 24 hours

Once the general meeting concludes, the company is required—under Regulation 30 read with Para A(13) of Part A of Schedule III of the SEBI (LODR) Regulations, 2015—to disclose the proceedings and voting outcome to all stock exchanges within 24 hours of the event.

This disclosure informs the market whether the resolution for appointing [name] as an independent director was put to vote and whether it was approved or defeated.

In cases where the appointment was approved through the alternative mechanism under Regulation 25(2A)—that is, the special resolution did not secure 75% approval but the dual thresholds were met—the disclosure should clearly explain this outcome. For example:

“The special resolution did not achieve the requisite 75% approval; however, the appointment is deemed approved as both thresholds under Regulation 25(2A) were satisfied—an ordinary resolution standard was met with [X]% votes in favor, and a majority of public shareholders voted in favor.”

This level of transparency is important because the alternative approval mechanism is relatively new. Clear and prompt disclosure helps investors, analysts, and other market participants understand how the mechanism was applied and prevents any misconception that the appointment failed when it was, in fact, validly approved through this alternate route.

Voting results submission within 2 working days

Following the general meeting, the company must submit detailed voting results to all stock exchanges in the format prescribed by Regulation 44(3) of the SEBI (LODR) Regulations, 2015. The submission must be made within two working days of the meeting’s conclusion.

The report presents a category-wise breakdown of voting—covering promoter and promoter group, public institutional investors, and public non-institutional investors—and specifies the number of votes cast in favour, against, and abstained, along with the corresponding percentages for each group.

This granular disclosure is crucial, especially when the alternative approval mechanism under Regulation 25(2A) applies. It enables verification that the appointment met both conditions: that more votes were cast in favour than against, and that a majority of public shareholders supported the proposal.

The results are certified by a scrutinizer, typically a practising Company Secretary or Chartered Accountant, who oversees the voting process to ensure transparency and accuracy. Once filed, the report becomes part of the permanent regulatory record of the company’s general meeting.

Form B—Insider Trading Disclosure Within 7 Days

Under Regulation 7(1)(b) of the SEBI (Prohibition of Insider Trading) Regulations, 2015, every newly appointed director, key managerial personnel (KMP), or promoter of a listed company is required to submit an initial disclosure of shareholding to the company within seven days of appointment.

This disclosure is made in Form B, which records the individual’s shareholding in the company as on the date of appointment. In most cases, independent directors do not hold any shares, but they are still required to file Form B showing nil shareholding to comply with the regulation.

The form is submitted to the company’s Compliance Officer, who maintains a register of insider disclosures and monitors compliance with trading restrictions. Although independent directors rarely trade in the company’s securities, they are considered “insiders” under the Regulations because their board position gives them potential access to unpublished price-sensitive information (UPSI). Accordingly, they are subject to the same disclosure and trading restrictions that apply to other connected persons within the company.

Step 9—Issuing appointment letter

Once all regulatory approvals and statutory filings are complete, the company formally documents the appointment by issuing a letter of appointment to the independent director.

Although the Companies Act, 2013 does not explicitly prescribe this requirement, the practice is mandated under Regulation 46(2)(b) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 for listed companies and is widely regarded as a governance best practice for all companies.

The appointment letter serves as the contractual framework for the director’s relationship with the company, clearly outlining the expectations, rights, and responsibilities attached to the role.

Typically, the letter covers:

(a) Term of appointment — specifying the start and end date;

(b) Nature of appointment — confirming it is as an independent director under Section 149 of the Companies Act;

(c) Roles and responsibilities — including participation in board and committee functions;

(d) Time commitment expectations — number of board and committee meetings per year and any additional duties;

(e) Remuneration details — sitting fees, committee fees, reimbursement policies, and any fixed annual compensation;

(f) Performance evaluation criteria — the parameters on which effectiveness will be assessed;

(g) Code of Conduct and governance obligations — compliance with the company’s code, insider trading regulations, and ethics policies;

(h) Confidentiality obligations — restrictions on sharing or using company information; and

(i) Termination provisions — the process and circumstances under which the appointment may end before the expiry of term.

While Schedule IV of the Companies Act outlines the general terms of appointment and duties of independent directors, removal before expiry must follow the procedure under Section 169 — that is, by a resolution of shareholders after providing the director a reasonable opportunity to be heard. The appointment letter should acknowledge this framework.

For listed companies, the terms and conditions of appointment are required to be disclosed on the company’s website under Regulation 46(2)(b). Therefore, while the letter itself should avoid commercially sensitive information, it must be sufficiently detailed to convey the scope of the role and the standards expected of the independent director.

Step 10—Statutory register entries

The final compliance step after an independent director’s appointment is updating the company’s statutory registers to reflect the change in board composition.

These registers are mandatory under the Companies Act, 2013 and must be maintained at the company’s registered office, open for inspection by directors, members, and regulatory authorities.

Register of directors and key managerial personnel (Section 170)

Under Section 170(1) of the Companies Act, 2013 read with Rule 17 of the Companies (Appointment and Qualification of Directors) Rules, 2014, every company is required to maintain a Register of its Directors and Key Managerial Personnel.

After the independent director’s appointment becomes effective, the company records the following particulars:

- Full name, Director Identification Number (DIN), parent’s name, date of birth, nationality, occupation, and residential address;

- Date of appointment and category of directorship (independent director);

- Date of cessation, when applicable; and

- Details of shareholding or debenture holdings, if any.

For independent directors, the shareholding entry is typically nil or minimal, since significant equity could affect independence. Any change in a director’s shareholding must be reflected in this register within 30 days of such change to keep records current.

Register of contracts and arrangements (Section 189 — Form MBP-4)

Under Section 189(1) of the Companies Act, 2013 read with Rule 16(1) of the Companies (Meetings of Board and its Powers) Rules, 2014, every company must maintain a Register of Contracts and Arrangements in which directors are interested, in Form MBP-4.

This register is based on the disclosures made by directors in Form MBP-1 under Section 184(1), where each director declares their interests in other entities. Once the independent director submits Form MBP-1, the company records those disclosures in the Register of Contracts and Arrangements under their name.

This creates a permanent reference that assists the board and auditors in determining whether a director has an interest in any matter coming before the board.

During the director’s tenure, if they notify any new interests or changes to existing ones, the register must be updated accordingly.

Before board meetings involving related-party contracts or arrangements, the company secretary refers to this register to identify directors who should recuse themselves from discussions or voting due to potential conflicts of interest.

Tenure, term limits, and cooling-off Period

Understanding how independent director tenure works is essential for effective board planning and renewal.

Sections 149(10) and 149(11) of the Companies Act, 2013 establish clear limits on how long a person can serve as an independent director and what happens once the maximum tenure has been reached.

These provisions prevent entrenchment—where independent directors become too comfortable with management and lose their critical edge—while still allowing continuity through limited reappointment.

Five-year term for independent directors

Under Section 149(10), an independent director may hold office for a term of up to five consecutive years on the board of a company. The phrase “up to” is significant—it gives flexibility to the board and shareholders to determine a tenure shorter than five years based on company needs or the director’s availability.

Any such tenure—whether two, three, or five years—constitutes one term for the purpose of Section 149(11). For instance, if an independent director serves a three-year first term and is later reappointed for four years, those two appointments together exhaust their two-term limit, even though the total duration is only seven years.

The term limit is about number of terms (maximum two), not about number of years (which could be anywhere from 2 to 10 years).

Maximum two consecutive rerms (10 Years Total)

Section 149(11) imposes an absolute limit: an independent director cannot hold office for more than two consecutive terms. Thus, a director serving two full five-year terms would complete the maximum permissible consecutive tenure of ten years.

Reappointment for the second term requires a special resolution of shareholders.

This higher threshold ensures that shareholders consciously evaluate the director’s performance and independence before extending their tenure.

This is one of the few instances where the law creates a higher voting threshold for continuing an existing arrangement rather than approving something new—reflecting the importance of fresh perspectives in independent director roles.

Three-year cooling-off period after two consecutive terms

Once an independent director completes two consecutive terms—whether totaling ten years or any shorter period—they must undergo a three-year cooling-off period in terms of section 149(11) before being eligible for reappointment to the same company’s board.

During this three-year break, the individual cannot be associated with the company in any capacity, whether directly or indirectly.

This restriction extends to roles such as executive director, consultant, advisor, or employee, ensuring a complete disassociation from the company.

This cooling-off requirement serves two key governance objectives:

- Preserving independence — it ensures that directors do not compromise their objectivity toward the end of their tenure in anticipation of future engagements with the company; and

- Encouraging board renewal — it compels companies to develop a robust pipeline of independent director candidates rather than recycling the same individuals indefinitely.

After the cooling-off period expires, the person becomes eligible once again for appointment as an independent director, with a fresh two-term cycle beginning at that point.

What are the post appointment compliance requirements for independent directors?

The appointment of an independent director initiates a set of continuing compliance requirements that remain in force throughout their tenure.

Many companies focus on getting the appointment process right but overlook these ongoing requirements, often inviting audit qualifications or regulatory scrutiny later. These continuing compliances are designed to ensure that the independent director remains truly independent, well-informed, and transparent in their role.

Annual declarations of independence

Every independent director is required to submit an annual declaration of independence confirming that they meet the criteria laid out in Section 149(6). This declaration which is given under section 149(7) must be given at the first meeting of the board in every financial year, in addition to the initial declaration at the time of appointment.

If, at any time during the year, circumstances arise that could compromise independence—such as acquiring more than 2 % voting rights, entering into a consultancy arrangement with the company, or a relative becoming a KMP—the director is expected to immediately inform the board. This continuous disclosure allows the board to evaluate the situation and take corrective action if necessary.

Separate meetings of independent directors

As per Schedule IV of the Companies Act, Independent directors must hold at least one meeting in each financial year, without the presence of non-independent directors or members of management. This exclusive session enables candid discussions among independent directors on:

- The performance of non-independent directors and of the board as a whole;

- The performance of the Chairperson, taking into account views of executive and non-executive directors; and

- The quality, quantity, and timeliness of information provided by management.

Minutes of this meeting are maintained separately, and any collective observations or recommendations are later communicated to the Chairperson or the full board.

Familiarisation and continuous training programs

Independent directors must remain informed about the company’s operations and the environment in which it operates.

Regulation 25(7) of SEBI LODR requires listed companies to conduct familiarisation programs to help directors understand:

(a) nature of the industry in which the listed entity operates;

(b) business model of the listed entity;

(c) roles, rights, responsibilities of independent directors; and any other relevant information.

These programs are not one-time inductions—they are ongoing initiatives throughout the director’s tenure, ensuring directors stay current with business and regulatory developments.

Companies must disclose details of these programs on their websites, including:

- Number of programs conducted during the year;

- Number of independent directors who attended;

- Aggregate hours spent by each director; and

- Topics covered.

These details also form part of the annual corporate governance report, demonstrating that independent directors are active, informed, and effective participants in board oversight.

How companies handle common appointment scenarios?

While the core procedure for appointing independent directors remains largely consistent, certain scenarios require specific procedural adaptations.

Whether it’s a listed company making a first-time appointment, an unlisted public company newly subject to independent director requirements, or a vacancy arising mid-term, understanding these scenario-based nuances helps ensure compliance without duplication or oversight.

First-time appointment in listed companies

For listed entities, first-time appointments of independent directors follow the complete procedural framework—including all steps under the Companies Act, 2013 and SEBI (LODR) Regulations, 2015.

Before the board meeting, the company should verify that the proposed director is registered in the Independent Directors’ Databank and has either passed or been exempted from the prescribed proficiency test under Rule 6 of the Companies (Appointment and Qualification of Directors) Rules, 2014.

At the board meeting, the resolution should explicitly state that the proposal concerns a first-term appointment, subject to shareholder approval.

The shareholder resolution is drafted as a special resolution under Regulation 25(2A) of SEBI LODR, with an explanatory note clarifying that if the special resolution does not achieve 75% approval, the alternative approval mechanism will apply—meaning the appointment can still be deemed approved if:

- The ordinary resolution standard (more votes for than against) is met; and

- A majority of public shareholders vote in favour.

Disclosure requirements are time-bound and sequential:

- Within 24 hours of the board meeting – disclose the board’s recommendation to all stock exchanges;

- Within 24 hours of the general meeting – disclose the voting outcome;

- Within two working days – submit detailed voting results under Regulation 44(3).

Statutory filings follow: Form DIR-12 (within 30 days of appointment), and Form MGT-14 if a special resolution was passed. After filings, the company issues a formal appointment letter, publishes the terms of appointment on its website, and begins familiarisation programs as required under Regulation 25(7).

First-time appointments in listed companies are compliance-intensive, but a structured approach ensures completeness and regulatory alignment.

Appointment in unlisted public companies

In unlisted public companies, the process mirrors that of listed entities, but SEBI LODR provisions—including disclosure and website requirements—do not apply.

The proposed director must still be registered in the databank and have cleared or been exempted from the proficiency test. The board considers the appointment, and shareholders approve it via an ordinary resolution, in line with Section 149(10) of the Companies Act.

Unlisted companies enjoy greater flexibility in disclosure timelines, since the 24-hour and two-day submission windows applicable to listed entities do not extend to them.

Nevertheless, Form DIR-12 must still be filed within 30 days, and if the company has constituted a Nomination and Remuneration Committee (NRC), its recommendation remains a mandatory prerequisite.

Issuing a formal appointment letter remains a best governance practice, even though it is not legally required—it helps set expectations and provides documentary clarity for both the company and the director.

Reappointment for a second five-year term—performance evaluation and resolution

When an independent director completes the first term, the reappointment process differs in two key respects.

- Performance Evaluation:

Schedule IV of the Companies Act mandates that reappointment must be based on the outcome of performance evaluation. The board—excluding the independent director under review—should assess participation, quality of inputs, judgment, attendance, committee contributions, and overall value addition during the first term. - Special Resolution Requirement:

Reappointment requires a special resolution under Section 149(10) of the Companies Act and Regulation 25(2A) of SEBI LODR. The alternative approval mechanism available for first-time appointments does not apply here. Thus, the reappointment succeeds only if at least 75% of votes cast are in favour.

The board resolution should note that the recommendation for reappointment is based on a positive evaluation outcome.

The explanatory statement in the notice to shareholders should explicitly identify this as a reappointment, summarise the director’s contributions, and justify the proposed continuation. Statutory filings include Form MGT-14 (for the special resolution) and Form DIR-12, specifying that it is a reappointment rather than a fresh appointment.

Filling a casual vacancy—procedure and timeline

When an independent director resigns, is removed, or otherwise vacates office mid-term, the resulting casual (intermittent) vacancy must be filled promptly.

The statutory rule for filling such vacancies is that they should be filled at the earliest but not later than the immediate next board meeting or three months from the date of vacancy, whichever is later. This timeline is prescribed under Rule 4 of the Companies (Appointment and Qualification of Directors) Rules, 2014.

There are two common procedural routes:

- the board may appoint an individual as an additional/alternate director under Section 161(1) to fill the vacancy, subject to shareholder regularisation at the next general meeting; or

- the company may hold an extraordinary general meeting to obtain shareholder approval for a direct appointment.

For listed companies, SEBI’s LODR framework treats replacement of an independent director as a time-sensitive governance obligation and expects the listed entity to comply with the same “immediate next board meeting or three months” standard (subject to the exception where the company already meets the minimum number of independent directors). Practically, failure to fill a required vacancy within this timeline may constitute non-compliance with applicable rules.

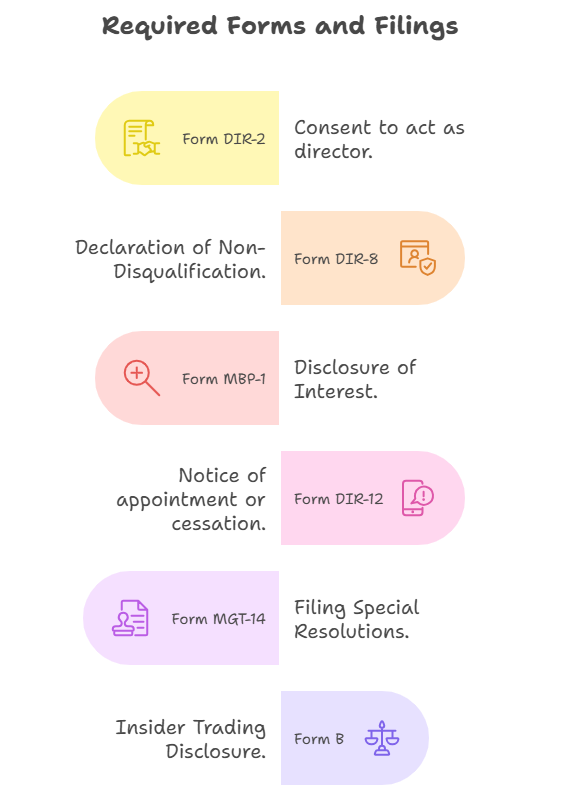

What forms and filings are required during the appointment process?

Let me give you a consolidated reference guide to all the key forms involved in independent director appointments—what each form is for, when it is needed, what information goes into it, and where it gets filed. Having this quick reference helps you stay organized during the appointment process and ensures you don’t miss any documentation requirements.

Form DIR-2—Consent to act as director

Form DIR-2 records the proposed director’s consent to act as a director of the company. It is obtained before placing the appointment proposal before the board or shareholders. The form contains the individual’s Director Identification Number (DIN), name, address, parent’s name, and a declaration that the person consents to act as a director and is not disqualified under Section 164 of the Companies Act, 2013. DIR-2 is not filed independently with the Registrar of Companies but is attached as a supporting document when Form DIR-12 is filed for the appointment. The original copy is retained in the company’s records.

Form DIR-8—Declaration of non-disqualification

Form DIR-8 is the declaration submitted by the proposed director confirming that none of the disqualifications specified in Section 164 apply to them. It confirms that the individual has not been convicted of offences involving moral turpitude or fraud, is not under disqualification by any court or tribunal, and has not defaulted on statutory filings or repayments. The form is submitted to the company prior to the board meeting at which the appointment is considered and is maintained as part of the company’s internal records. It is attached to Form DIR-12 at the time of filing the appointment with the Registrar.

Form MBP-1—Disclosure of interest

Form MBP-1 is filed under Section 184 by the director to disclose all entities (companies, firms, LLPs, bodies corporate, associations) in which they hold directorships, partnerships, memberships, or ownership interests. This allows the company to identify potential conflicts of interest when the board considers contracts or transactions with those entities. The director submits this to the company, which maintains it in the Register of Contracts and Arrangements. Whenever the director’s interests change—new directorships acquired, old ones relinquished—they must update their MBP-1 disclosure within 30 days.

Form DIR-12—Notice of appointment or cessation

Form DIR-12 is the statutory filing made with the Registrar of Companies to notify the appointment or cessation of a director. In the case of an independent director appointment, DIR-12 is filed within thirty days of the effective date of appointment—either from the date of the board resolution, if the person is appointed as an additional director, or from the date of the shareholders’ resolution where the appointment is approved in a general meeting. The form includes details such as the director’s DIN, name, address, date of appointment, and category of directorship (“independent director”). Attachments typically include the relevant board or shareholder resolutions, along with Forms DIR-2, DIR-8, and MBP-1. The filing is made through the MCA portal, with fees determined by the company’s authorised share capital.

Form MGT-14—Filing special resolutions

Form MGT-14 is used for filing resolutions and related documents with the Registrar under Section 117 of the Companies Act, 2013. It is required when shareholders approve the appointment or reappointment of an independent director through a special resolution—such as in listed companies or during second-term reappointments. MGT-14 must be filed within thirty days of the resolution’s passing and includes a certified copy of the special resolution together with the explanatory statement from the general meeting notice. Where the appointment is approved through an ordinary resolution, only DIR-12 is required; MGT-14 is not applicable.

Form B—Insider trading disclosure for listed companies

Form B, prescribed under Regulation 7(1)(b) of the SEBI (Prohibition of Insider Trading) Regulations, 2015, is the initial disclosure of securities holdings that every director, key managerial personnel, and promoter must provide upon appointment. It is submitted within seven days of assuming office to the company’s compliance officer. The disclosure covers any holdings in equity shares, debentures, warrants, or other securities of the company. Independent directors generally do not hold securities, but even in such cases, a nil disclosure must be filed to establish the baseline shareholding from which future trading disclosures will be monitored.

Conclusion

The appointment of an independent director is not merely a procedural step but a structured governance framework that builds transparency and trust. Every step, from databank registration and consent forms to board recommendation and shareholder approval, reinforces transparency and independence in how directors join the board.

The alternative approval mechanism introduced by SEBI in November 2022 marks a key shift in governance philosophy. By combining the ordinary resolution threshold with a majority vote from public shareholders, it ensures that independent directors genuinely have the confidence of all stakeholders—not just promoters.

For candidates, this process provides assurance that their role rests on objective assessment and formal accountability rather than informal influence. Once appointed, ongoing requirements—such as annual independence declarations and familiarisation programmes—help sustain that independence in practice.

Ultimately, the process serves as a foundation for effective board oversight, signalling both the company’s commitment to good governance and the director’s readiness to serve with integrity and informed judgment.

Frequently Asked Questions

Can a company appoint an independent director for less than 5 years?

Yes, a company can appoint an independent director for a term of less than five years. Section 149(10) states that independent directors shall hold office for a term “up to five consecutive years,” which means any period not exceeding five years is permissible. However, regardless of whether you appoint for five years, three years, or two years, that period counts as “one term” for purposes of the two-consecutive-term limit under Section 149(11). The MCA clarified this in response to industry representations—even a shorter term is considered a complete term, so an independent director appointed for three years cannot serve more than one additional term before the mandatory three-year cooling-off period applies.

What is the maximum number of listed companies where a person can be an independent director?

A person can serve as an independent director in a maximum of seven listed companies at any one time, per Regulation 25(1) of SEBI LODR. Additionally, if that person is serving as a whole-time director (executive director) in any listed company, they can be an independent director in only three other listed companies. The Companies Act also imposes an overall directorship limit under Section 165(1)—maximum 20 directorships in total (including all public and private companies, both executive and non-executive roles)—but within that overall cap, the SEBI limit of seven listed company independent directorships is specifically applicable to independent director roles in listed entities.

Can a practicing company secretary or chartered accountant be appointed as an independent director?

Yes, a practicing professional like a company secretary, chartered accountant, cost accountant, or advocate can be appointed as an independent director because independent directors are non-executive directors who don’t have employment relationships with the company. A practicing CS or CA can hold multiple independent directorships across different companies as long as they comply with their respective professional body’s guidelines about number of directorships and don’t exceed statutory limits (7 listed company IDs, 20 total directorships). The key independence criteria are met as long as the practicing professional doesn’t have a client relationship with the company (providing audit, secretarial, or consultancy services) within the three years immediately preceding their proposed appointment.

Can a company secretary working in a company be appointed as an independent director of the same company?

No, a company secretary employed by a company cannot be appointed as an independent director of that same company. Section 149(6) specifies that an independent director should not be or have been a key managerial personnel (which includes the company secretary) of the company in any of the three financial years immediately preceding the year of their proposed appointment. Since the employed company secretary is currently a KMP, they fail the independence criteria. However, a company secretary employed in Company A can absolutely be appointed as an independent director in Company B, C, or D (different companies), as long as those companies aren’t holding, subsidiary, or associate companies of Company A and the CS doesn’t provide professional services to those companies.

What is the minimum age to be appointed as an independent director?

Under the Companies Act, 2013, the minimum age to be appointed as any director (including independent director) is 18 years—there’s no separate minimum age specified for independent directors. However, for listed companies, SEBI LODR creates an additional requirement: Regulation 17(1A) specifies that no person shall be appointed or continue as a non-executive director who has attained the age of 75 years unless a special resolution is passed to that effect. So while the minimum age is 18, there’s a maximum age threshold of 75 for non-executive directors (including independent directors) in listed companies, which can only be exceeded with explicit shareholder approval through special resolution explaining why continuing beyond 75 is appropriate.

Does an independent director need to pass the proficiency test before appointment?

No, an independent director does not need to pass the proficiency test before being appointed. Rule 6(4) of the Directors Rules requires that every individual whose name is included in the databank must pass the online proficiency test within two years from the date of inclusion of their name in the databank. The MCA clarified that while databank registration should ideally happen before appointment, the proficiency test can be completed within the two-year window after databank registration. However, there’s a risk: if the director is appointed and then fails to pass the test within two years, their name will be removed from the databank and they cannot continue as an independent director, creating a board composition compliance issue for the company.

What happens if an independent director fails the proficiency test?

If an independent director fails to pass the online proficiency test within two years from the date of their name being included in the Independent Directors’ Databank, their name will be removed from the databank per Rule 6(4). Once removed from the databank for this reason, they cannot continue to serve as an independent director in any company. However, the good news is there’s no limit on the number of attempts for passing the test, and there’s no passing deadline per attempt—only the overall two-year window from databank inclusion. If someone’s name is removed for failing to pass within two years, they can subsequently take the test, pass it, reapply to the databank, and potentially be appointed as an independent director again in the future. During the period their name is not in the databank, they could serve as a regular non-executive director (not classified as independent) if the company appoints them to that role.

Can an existing independent director be treated as a non-executive rotational director?

No, existing independent directors cannot be converted into or treated as non-executive rotational directors. Section 152(6) of the Companies Act explicitly states that for the purpose of calculating the total number of directors who are liable to retire by rotation, independent directors shall not be included. Section 149(13) further specifies that the provisions regarding retirement by rotation do not apply to independent directors. This means independent directors are a separate category with their own tenure rules (up to two consecutive five-year terms) and cannot be subject to the rotation provisions that apply to regular non-executive directors. If a company appointed someone as an independent director under the Companies Act, 2013, they continue as an independent director under the tenure rules applicable to that role—they don’t convert to rotational status.

Is there a time limit to fill a casual vacancy of an independent director?

Yes, Rule 4 of the Companies (Appointment and Qualification of Directors) Rules, 2014 specifies that any intermittent vacancy of an independent director shall be filled up by the board at the earliest but not later than the immediate next board meeting or three months from the date of such vacancy, whichever is later.

Are independent directors liable for company non-compliance?

Independent directors have limited liability for company non-compliance compared to executive directors. Section 149(12) creates a specific liability shield: an independent director (or any non-executive non-promoter director) shall be held liable only in respect of acts of omission or commission by the company that occurred with their knowledge, attributable through board processes, and with their consent or connivance, or where they have not acted diligently. This means if a compliance breach happens and the independent director wasn’t aware of it, or it wasn’t discussed in board meetings, or they raised objections and registered dissent, they’re not liable. However, if board papers clearly showed the company was violating regulations, the independent director attended the meeting, was aware of the violation, and either approved it or failed to act diligently to prevent it, they can be held liable.

Can an independent director receive stock options?

No, independent directors cannot receive stock options. Section 149(9) of the Companies Act explicitly states: “an independent director shall not be entitled to any stock option.” This prohibition ensures independent directors don’t have equity-based incentives that might compromise their independence or align their interests too closely with promoters or management. However, independent directors can receive remuneration by way of sitting fees for board and committee meetings (under Section 197(5)), reimbursement of expenses for attending meetings, and profit-related commission if approved by members. If a company has inadequate or no profits, Schedule V allows independent directors to receive remuneration up to specified limits even without profits, exclusive of sitting fees.

What disclosures must listed companies make after appointing an independent director?