Complete guide to Independent Director courses in India: Compare IICA, LawSikho, KPMG, IIM Bangalore programs. Registration fees, ROI analysis, eligibility criteria & appointment strategy.

Table of Contents

If you’re a mid-career professional, a retiring executive, or an experienced specialist looking for your next big chapter? Then, becoming an Independent Director might be one of the most rewarding moves you make.

And the good news is that the boardroom isn’t as far away as you think.

Since 2019, India’s independent director landscape has transformed. What once demanded decades of corporate pedigree now requires passing an online proficiency test and making smart certification choices.

The rewards?

In FY24, companies routinely paid ₹63,500 as a sitting fee for a single board meeting — and 29 Nifty-100 companies paid over ₹1 lakh for the same.

But the catch is that the path isn’t always straightforward. Most aspiring directors find themselves navigating a maze of certification programs, regulatory requirements, and career-positioning decisions — and many get stuck.

I know because I’ve spent months analysing every major independent director certification program in India — from the mandatory IICA databank registration to premium options like KPMG, IIM Bangalore, and LawSikho.

And here’s what I found:

- Many professionals waste hard-earned money on courses that don’t match their experience level.

- Others skip critical certification steps that companies actually verify before appointing directors.

This guide is here to change that. In this guide: –

- You’ll discover which certifications truly matter (spoiler: not all are mandatory).

- You’ll learn how to choose between seven leading programs based on your career stage.

- And most importantly, you’ll understand what happens after certification — including the post-certification appointment strategy that 95% of courses never teach.

A lot of professionals dont know that getting certified and getting appointed are two very different challenges.

Just so you know, the next board seat won’t go to the most senior person in the room but it’ll go to the one who is prepared. And with the right roadmap, that person can be you.

Why Become a Certified Independent Director?

Certification opens doors to lucrative board opportunities that would otherwise remain inaccessible.

As an independent director, you can build a portfolio of 3-5 directorships generating ₹20-50 lakh annually while leveraging your decades of professional expertise in a strategic advisory capacity.

Certification demonstrates your commitment to professional governance standards, differentiates you from uncertified candidates competing for the same positions, and provides you with the regulatory knowledge and best practices needed to discharge your fiduciary duties effectively.

Why Do Companies Value Certified Independent Directors?

Companies are legally required to appoint independent directors who meet stringent regulatory standards under Section 149 of the Companies Act 2013. Here’s what makes certified directors valuable:

Regulatory Compliance Made Easy: Listed companies need at least one-third of their board to be independent directors. Public companies with paid-up capital exceeding ₹10 crore or turnover above ₹100 crore must appoint at least two independent directors. When companies hire certified directors, they’re buying pre-vetted compliance.

Reduced Liability Risk: Directors certified through recognized programs understand fiduciary duties, related-party transaction restrictions, and disclosure requirements. This knowledge protects both the company and board members from regulatory penalties.

Governance Credibility for Stakeholders: Independent directors act as watchdogs ensuring good governance practices, moderating conflicts of interest, and providing unbiased oversight. Certification signals to investors and regulators that your company takes governance seriously.

Access to Specialized Expertise: Certified programs often attract professionals with finance, legal, technology, and operational backgrounds. Companies gain access to this specialized talent pool through the IICA databank and program alumni networks.

How IICA Certification Accelerates Your Career?

IICA certification isn’t just a regulatory checkbox—it’s a career accelerator when you understand how to leverage it.

Databank Visibility to 3990 + Companies: The IICA databank connects over 38,000 registered independent directors with 3990+ companies actively searching for board members as on 12th October 2025. Your profile becomes searchable by companies filtering for specific qualifications, industry experience, and skills.

Credibility Through Government Backing: IICA operates under the Ministry of Corporate Affairs. It’s the only institute notified under Section 150 of the Companies Act 2013 to maintain the official independent directors databank and conduct proficiency tests. This government imprimatur carries weight that private certifications lack.

Continuous Learning Resources: The databank provides access to an integrated Learning Management System with board essentials courses, board practice modules, monthly newsletters, webinars, and case studies from major corporations. You are not just certified—you’re continuously educated.

Networking Within the Community: Registration connects you with 11500+ women directors (as on 12th October 2025) and thousands of practicing independent directors. These connections often lead to referrals, co-directorship opportunities, and insights into board openings.

The certification alone won’t get you appointed, but it removes the first barrier—eligibility verification. Companies can instantly confirm your credentials, focus their evaluation on your expertise fit, and move faster toward appointment.

Who Should Pursue Independent Director Certification?

Which Professionals Benefit Most from Their Professional Background?

Not all careers translate equally well to independent directorship. Here are backgrounds that companies actively seek:

Finance & Accounting Professionals: CFOs, chartered accountants, and financial analysts are perpetually in demand. Independent directors often serve on audit committees where financial statement interpretation and risk assessment expertise is crucial. If you’ve managed P&L statements, understand IFRS/Ind AS, or have auditing experience, you’ll stand out.

Legal & Compliance Experts: Company secretaries, corporate lawyers, and regulatory compliance professionals bring essential governance knowledge. You’ll be valued for understanding Companies Act provisions, SEBI regulations, and contractual risk assessment.

Technology & Digital Transformation Leaders: As companies digitize operations, boards need directors who understand cybersecurity risks, data privacy regulations, and digital strategy. CTOs, CIOs, and technology consultants with 10+ years experience find eager corporate audiences.

Industry-Specific Domain Experts: If you have spent 15+ years in pharmaceuticals, manufacturing, renewable energy, or fintech, companies in those sectors want your operational insights. Domain expertise helps boards make informed strategic decisions.

Senior Executives Approaching Retirement: CEOs, COOs, and division heads transitioning out of full-time roles find independent directorship provides part-time engagement, continued relevance, and supplemental income. Your leadership experience translates directly to board oversight responsibilities.

Entrepreneurs Who’ve Scaled Businesses: Founders who’ve raised capital, managed growth, and exited successfully understand both operational and governance challenges. Your entrepreneurial perspective helps boards guide management teams.

What matters less: Your academic pedigree or specific degree.

Any bachelor’s degree from a recognized institution qualifies you for registration—there’s no discipline requirement. Your professional achievements matter far more than your undergraduate major.

How Much Experience Do You Need Before Pursuing Independent Director Certification?

The legal minimum is surprisingly low—but market realities tell a different story.

Legal Minimum: You must be 21 years old to register with the IICA databank; there’s no maximum age limit. Technically, a fresh graduate could register tomorrow.

Market Reality for First Appointment: Companies rarely appoint independent directors with less than 10 years of professional experience.

Here’s why: board members must provide strategic guidance, challenge management assumptions, and assess risks across complex business scenarios. That requires seasoned judgment.

Programs like KPMG explicitly target “senior professionals with 20+ years of leadership experience” because they know companies want directors who have seen multiple business cycles, managed crises, and led teams.

The Experience Sweet Spot: Most successful first-time appointees fall into these brackets:

- Mid-Career Professionals (10-15 years): If you are a practicing CA, CS, or lawyer with deep compliance expertise, you can secure appointments to unlisted companies or smaller listed firms. Your technical knowledge compensates for limited leadership tenure.

- Senior Managers (15-20 years): At this stage, you’ve likely held GM, VP, or practice head positions. You’re attractive to mid-cap companies seeking a balance of expertise and affordability.

- CXO-Level Executives (20+ years): Former CEOs like Om Prakash Bhatt (ex-SBI Chairman) and Adil Zainulbhai (McKinsey partner) command premium sitting fees across multiple blue-chip boards. At this level, your network matters as much as your credentials.

My Recommendation: If you have less than 10 years experience, get certified now but focus on building specialized expertise first. Use the next 2-3 years to develop board-relevant skills—financial analysis, regulatory knowledge, strategic planning—that make you appointment-ready when you cross the 10-year mark.

Are You Eligible to Become an Independent Director Under Section 149(6)?

Eligibility isn’t automatic. Section 149(6) of the Companies Act 2013 sets both positive qualifications and negative disqualifications that determine whether you can legally serve as an independent director.

Core Positive Requirements:

You must be a person of integrity with relevant expertise and experience (assessed by the appointing board). You cannot be:

- A managing director, whole-time director, or nominee director of the company

- Related to promoters or other directors of the company

Financial Independence Criteria:

You cannot hold equity shares exceeding ₹50 lakh face value or 2% of paid-up capital (whichever is lower) in the company or its holding/subsidiary/associate companies. This prevents directors with significant ownership stakes from claiming independence.

You must not have had pecuniary relationships with the company exceeding 10% of your total income in the two preceding years or current year, excluding director’s remuneration. If you were a consultant, vendor, or service provider earning substantial income from the company, you’re disqualified.

Professional Relationship Restrictions:

You cannot have been a partner or executive of the company’s auditors, lawyers, or consultants during the preceding three years. This cooling-off period prevents former professional advisors from immediately joining boards where they might have conflicts of interest.

You must not be a material supplier, customer, or lessor/lessee of the company. “Material” typically means relationships exceeding 2% of turnover.

Relative Relationship Prohibitions:

None of your relatives can be indebted to the company for ₹50 lakh or more, or have provided guarantees for third-party debts to the company during the two preceding years or current year. This prevents indirect financial dependencies that could compromise independence.

Disqualifications That Block Registration:

You cannot register if you’re an undischarged insolvent, convicted of moral turpitude offenses with 6+ month sentences, disqualified by court order, haven’t paid share call money for 6+ months, or were found guilty of related party transaction violations under Section 188 in the preceding five years.

The Practical Check: Before paying registration fees, review these criteria honestly. If you’ve worked closely with a company as a consultant, auditor, or major vendor within the last three years, you’re ineligible to join their board as an independent director—regardless of your qualifications.

Most professionals with 10+ years of varied experience meet these independence criteria. The restrictions primarily catch those with existing commercial or advisory relationships with specific companies they’re targeting.

IICA Certification & Registration Guide

What is the Indian Institute of Corporate Affairs (IICA)?

The Indian Institute of Corporate Affairs (IICA) is an autonomous institute established under the Ministry of Corporate Affairs, Government of India. Think of it as the regulatory training arm for India’s corporate sector.

IICA was notified under Section 150(1) of the Companies Act 2013 with three core mandates:

Mandate 1: Create and Maintain the Independent Directors Databank: The databank serves as a central repository connecting qualified independent directors with companies legally required to appoint them. It’s essentially a government-run LinkedIn for board positions.

Mandate 2: Conduct Online Proficiency Self-Assessment Tests: IICA administers the mandatory online test that aspiring and existing independent directors must pass to register with the databank. The test validates your knowledge of company law, securities regulations, board practices, and corporate governance.

Mandate 3: Provide Capacity Building Programs: IICA develops training modules, webinars, and certification programs to enhance independent directors’ effectiveness in their governance roles. While you can register with the databank after passing the proficiency test, IICA also offers optional advanced training.

Why IICA’s Role Matters: Before 2019, independent director appointments were informal. Companies relied on personal networks and promoter connections. The Ministry of Corporate Affairs released new rules on October 22, 2019, designating IICA as the sole authorized body to maintain the databank and conduct proficiency tests. This centralized credentialing brings transparency to what was once an opaque process.

IICA vs. Other Training Providers: Here’s where confusion arises.

IICA is both the regulatory authority (mandatory databank registration and test) AND a training provider (optional certification courses). Organizations like LawSikho, KPMG, IIM Bangalore, and ICSI offer competing training programs, but ALL roads lead back to IICA for the final databank registration and proficiency test.

You cannot bypass IICA to become an officially recognized independent director in India—but you can choose whether to train through IICA’s courses or alternative programs before taking the IICA proficiency test.

Is IICA Databank Registration Mandatory?

Yes, under Rule 6 of the Companies (Appointment and Qualification of Directors) Rules, 2014, two categories of individuals are legally required to register with the IICA databank:

- Existing independent directors: Anyone who was serving as an independent director as of December 1, 2019 (the commencement date of the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules, 2019) was required to register within thirteen months, i.e., by January 1, 2021. This deadline has long passed, and such directors should have completed their registration years ago.

- Prospective independent directors: Anyone intending to be appointed as an independent director after December 1, 2019 must register before their appointment.

There are no exemptions from this registration requirement. Every individual falling under either category must register with the IICA databank, regardless of their experience, qualifications, or the nature of the company where they serve or intend to serve.

What is the Independent Director’s Databank and How Does It Work?

The Independent Director’s Databank is a comprehensive online platform developed by IICA and the Ministry of Corporate Affairs to connect eligible independent directors with companies searching for board members. Think of it as a specialized job portal meets professional credentialing system.

For Individuals (Supply Side): You create a detailed profile including:

- Educational qualifications and professional certifications

- Current and past directorship positions

- Industry expertise and functional specializations

- Skills, languages, and geographic preferences

- Proficiency test results and training certifications

For Companies (Demand Side): Listed and unlisted companies register with the databank by submitting their CIN details, designating up to two officers who receive search access. These designated officers can:

- Search the databank using advanced filters (industry experience, qualifications, location, specific skills)

- Review candidate profiles matching their requirements

- Shortlist potential directors for board evaluation

- Contact candidates directly through the platform

The Search Process: When a company needs an independent director, their designated officer logs into the databank portal. They might search for “Chartered Accountant + Pharmaceutical Industry Experience + 15+ years” or “Technology Background + Cybersecurity Expertise + Mumbai-based.” The system returns matching profiles ranked by relevance.

Privacy Controls: You control your profile visibility through privacy settings during registration. You can choose full visibility (recommended for active job seekers), limited visibility (showing credentials but not contact details until you approve), or restricted access.

Subscription Model: The databank operates on a subscription basis—your profile remains active only during your paid subscription period (1 year, 5 years, or lifetime). Expired subscriptions result in profile delisting.

Search Volume Statistics: As of October 12, 2025, companies have conducted over 18,000 of searches through the databank platform. This demonstrates active usage by hiring companies, making registration worthwhile.

What the Databank Is NOT: It’s not a job guarantee platform. Registration doesn’t ensure appointments—it ensures visibility. Think of it as getting your name in the phonebook; companies still need to dial your number, conduct interviews, and validate your fit.

How to Register on the IICA Independent Directors’ Databank

Registering with the Independent Director Databank is a two-part process.

First, you need to create an account on the MCA (Ministry of Corporate Affairs) portal.

Then, you must log in through the MCA system to complete your registration on the IICA Independent Director’s Databank.

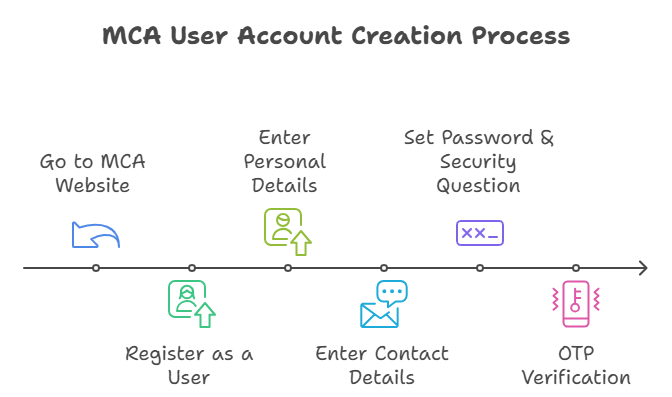

Part I: Creating an MCA Account

To begin, you must create your MCA User Account.

Step 1: Go to the MCA Website

- Visit MCA Portal

- Click on Login/Sign up at the top-right corner of the homepage.

Step 2: Register as a User

- On the User Login/Registration page, click Register under User Login.

- In the User Registration section:

- Select Registered User as the User Category.

- Select Individual as the User Role.

- Enter your PAN card details (in CAPITAL letters).

- Select Registered User as the User Category.

- Click Next.

Step 3: Enter Personal Details

Fill in the following:

- First name, middle name (if any), last name

- Date of birth, gender, profession, and industry of operation

- Click Next.

Step 4: Enter Contact Details

- Provide your address, mobile number, and email ID.

Step 5: Set Password & Security Question

- Create a secure password.

- Choose a password recovery question for account recovery.

- Click Create my account.

Step 6: OTP Verification

- Enter the OTP sent to your registered mobile number.

- Registration is now complete.

Please note that Your User ID will be sent to your registered email. This may take a few days (up to a week). Once you receive it, you can proceed to Part II.

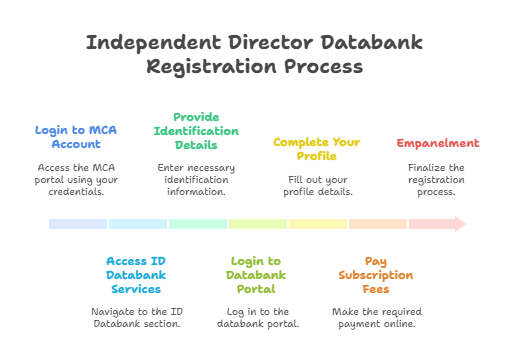

Part II: Independent Director Databank Registration

Now that your MCA account is active, follow these steps:

Step 1: Login to MCA Account

- Go to MCA Portal.

- Click Login/Sign Up.

- Enter your email ID and MCA password, along with Captcha.

- Select Login for V3 Filing.

Step 2: Access ID Databank Services

- Once logged in, go to ‘MCA Services’ tab.

- From the dropdown, click ‘ID Databank Services’ → Individual Registration.

Step 3: Provide Identification Details

You will be asked:

- Do you have a valid DIN? (Yes/No)

or - Do you have a valid PAN? (Yes → Enter PAN number)

or - Do you have a Passport? (Yes → Enter Passport number)

Please note, if you have a valid DIN then you do not required PAN/Password for registration. In case you do not have a DIN then only apply using PAN or Passport.

You will receive an otp for verification. Fill in the OTP.

- Click Proceed.

- You will be redirected to the Independent Director’s Databank Portal.

Step 4: Login to Databank Portal

- Click Login with OTP.

- Enter your email ID or mobile number, then request OTP.

- Enter the OTP received and click Login.

Step 5: Complete Your Profile

Fill in details to build your Independent Director profile:

- Personal details (matching PAN, DOB, contact info)

- Educational qualifications (upload degree certificates)

- Professional experience (previous directorships, KMP positions, relevant expertise)

- Areas of specialization (industry sectors, finance, law, operations, etc.)

You can choose what information is visible to companies.

Step 6: Pay Subscription Fees

Choose one of the subscription options:

- ₹5,000 + GST → 1-Year Subscription

- ₹15,000 + GST → 5-Year Subscription

- ₹25,000 + GST → Lifetime Subscription

Make the payment online to activate your account.

Final Step: Empanelment

Once payment is complete, you are now officially empanelled in the Independent Director Databank.

From here, you can also attempt the Independent Director Online Self-Proficiency Test to further strengthen your profile.

Post-Registration Access: You can now access the integrated Learning Management System, book proficiency test slots, practice mock tests, and update your profile anytime. Companies searching the databank will see your profile based on your privacy settings and subscription status.

You may also read my article on “Complete Guide to Independent Director Exam: Syllabus, Eligibility & Preparation Strategy” to get a complete overview of the Independent Director Test.

What Services Does IICA Provide to Registered Independent Directors?

Registration isn’t just about being searchable—you gain access to substantial resources designed to enhance your effectiveness as a board member.

Service 1: Integrated Learning Management System (LMS)

The LMS provides comprehensive eLearning courses divided into two main categories: Board Essentials Courses and Board Practice Courses. Here’s what’s inside:

Board Essentials Courses: These provide walkthroughs of fundamental Companies Act 2013 clauses and reinforce existing knowledge on processes and concepts. Topics include company incorporation, share capital structure, director liabilities, board committees, and general meetings.

Board Practice Courses: These offer detailed overviews of practical board operations—how companies incorporate, share issuance rules, prospectus requirements, board evaluation methods, exemplary board characteristics, pre-joining due diligence, building resilient companies, financial ratio analysis, and independent director performance evaluation.

Learning Formats: Content is available in multiple formats including video lectures, quizzes, e-books, webinars, and podcasts to accommodate different learning preferences.

Progress Tracking: Your personal dashboard showcases course completion progress, certificates earned, and modules finished. The system analyzes your profile and creates customized course recommendations based on your interests and learning history.

Service 2: Monthly Newsletter “The Hub”

IICA publishes a monthly newsletter covering regulatory updates, corporate governance trends, case study analyses, and best practices from leading Indian companies. This keeps you current on evolving board responsibilities.

Service 3: Webinars and Masterclasses

The databank regularly conducts webinars and masterclasses with industry experts, practitioners, and academicians. These sessions are notified on the homepage and often feature interactive Q&A with experienced board members.

Service 4: Online Proficiency Self-Assessment Test Access

Once registered, you gain access to unlimited mock tests for proficiency test preparation. These mock tests familiarize you with the test environment, question format, and system requirements. Mock tests contain 15 questions: 9 on board essentials and 6 on board practice.

When ready, you can book your actual proficiency test slot. Three test slots are available daily—morning, afternoon, and evening—allowing you to schedule the exam at your convenience from home or office.

Service 5: Case Study Library

The platform provides case studies on major global corporations offering concentrated reference points for independent directors facing similar governance challenges.

Service 6: Regulatory Updates and Compliance Alerts

The system sends SMS and email notifications about important regulatory changes, required actions, and compliance deadlines relevant to independent directors.

Service 7: Profile Visibility to Companies

Your profile information is provided to companies required to appoint independent directors after they pay a reasonable access fee to IICA. This generates inbound interest from companies searching for candidates matching your qualifications.

Service 8: Networking Forums and Discussions

The databank facilitates networking among registered independent directors through discussion forums and virtual communities centered on corporate governance topics.

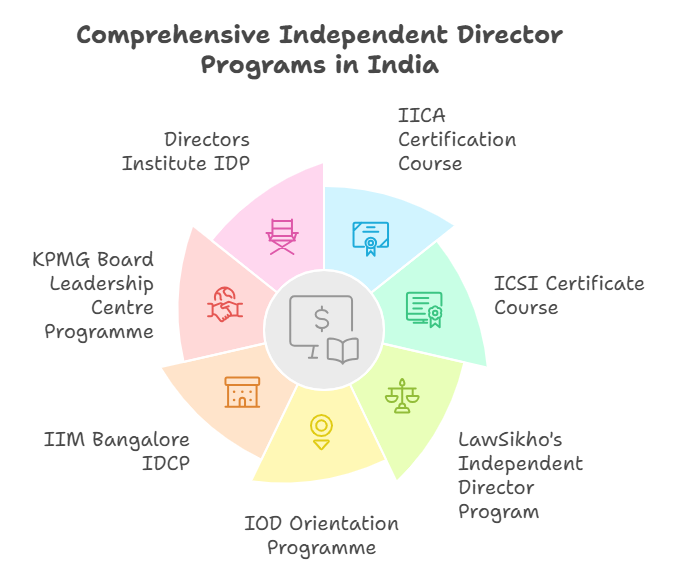

Top Independent Director Courses and Programs in India: Comprehensive Comparison

Top Independent Director Courses and Programs in India?

Beyond mandatory IICA registration, seven prominent training programs prepare professionals for independent directorship roles. Each program targets different experience levels, learning preferences, and budget ranges. Here’s your complete comparison guide:

IICA Certification Course for Independent Directors

Program Overview: This is IICA’s own optional certification program—separate from the mandatory databank registration and proficiency test.

Duration and Format: The Director’s Certification Program in Corporate Governance runs 4 months with 21 online sessions delivered via a sophisticated Learning Management System. Sessions are live, conducted on Thursdays & Fridays from 4:30 PM to 6:00 PM, and accessible through the sophisticated LMS platform.

Target Audience: Designed for operational-level executives in Central Public Sector Enterprises (CPSEs), government companies, and professionals seeking foundational board governance knowledge.

Curriculum Highlights: The program covers company law compliance basics, board committee structures, SEBI LODR requirements, financial statement interpretation, and case studies on corporate governance failures and successes.

Faculty: Program is taught by faculty of national and international repute with extensive experience in policy-making, academia, and corporate practice.

Fees: ₹50,000 + 18% GST = ₹59,000 (total ₹59,000). Corporate discount of 10% on basic fee available when organizations nominate 3 or more delegates. No discount for individual nominations.

Certificate: Upon completion, you receive an IICA certificate co-branded with the Ministry of Corporate Affairs, which carries official government recognition.

Unique Advantage: Since IICA administers the proficiency test, their training aligns perfectly with test requirements. If you complete this certification, you are reasonably well-prepared for the mandatory proficiency exam.

Best Suited For: Government officers, PSU employees, and first-time board aspirants with limited private sector governance exposure who want foundational training from the regulatory authority itself.

Please note that the above details are based on Batch 17 (commencing June 2025). For updated information on the latest batch including current fees, schedule, and curriculum modifications, please check IICA’s official website or contact the course lead directly.

ICSI Certificate Course on Independent Directors

Program Overview: The Institute of Company Secretaries of India (ICSI) offers a certificate course on Independent Directors specifically designed for company secretaries, ICSI members, students, and professionals seeking structured board training with strong compliance and secretarial focus.

Duration and Format: Approximately 3-month program (July to September) with 15-20 hours of training delivered through weekly live webinar sessions. Sessions are conducted every Friday from 3 PM to 5 PM (approximately 2 hours each). While live attendance is encouraged for interactive learning, all session recordings, reference materials, and PPTs are made available on ICSI-LMS platform for one year, allowing participants to review content at their convenience.

Target Audience: Primarily targets ICSI members, ICSI Executive Programme students, and graduates from any stream recognized universities.

Curriculum Highlights: Covers Companies Act provisions relevant to independent directors, board committee roles (audit, nomination and remuneration, stakeholder relationship), corporate social responsibility, related party transactions, and insider trading regulations.

Fees: ₹7,500 + GST for ICSI members and students; ₹15,000 + GST for non-members. This makes it one of the most affordable structured programs available.

Certificate: ICSI Certificate of Completion awarded to candidates upon successful completion of both the MCQ-based assessment test and qualifying project report.

Assessment: Two-component evaluation system:

- MCQ Based Test – 50% weightage

- Project Report – 50% weightage

Both components must be successfully completed to receive the certificate.

Unique Advantage: Strong focus on statutory compliance, board meeting procedures, and secretarial practices that company secretaries excel at. If you are a CS professional, this leverages your existing knowledge base.

Best Suited For: Company secretaries, legal professionals, and compliance managers with 5-10 years experience seeking affordable, compliance-focused board training.

Please note: – the above details are based on Batch 9 (Registration: 10 July 2025 to 14 September 2025; Commencement: 19 September 2025). For updated information on the latest batch including current fees, schedule, and curriculum modifications, please visit www.icsi.edu or contact [email protected] / call 0120-4522089/79. Registration once done cannot be cancelled or transferred and is non-refundable.

LawSikho Independent Directors’ Professional Development Program

Program Overview: LawSikho offers a comprehensive NSDC-certified program designed for aspiring board members, corporate leaders eyeing board transitions, legal professionals, entrepreneurs, and seasoned professionals approaching retirement who want not just certification but actual board appointment strategy.

Duration and Format: The program runs approximately 6 months with 48 live interactive classes (2 classes per week), typically held on Sundays or after 8 PM on weekdays to accommodate working professionals. The course combines live sessions, 400+ pre-recorded video lectures, comprehensive case study discussions, and practical application exercises. All content is delivered through a sophisticated learning platform accessible on any device, with 3 years of online access to updated materials.

Target Audience:Specifically designed for professionals with 10+ years of experience in corporate sectors, including CEOs, CFOs, COOs, C-suite executives, lawyers, accountants, company secretaries with a decade or more of experience, HR professionals, entrepreneurs, and anyone approaching retirement seeking lucrative post-retirement board opportunities.

Curriculum Highlights: The program provides extensive coverage including:

- 1500+ MCQs for practice and assessment

- 200+ comprehensive notes

- 7 major case studies (WorldCom, Enron, Volkswagen, Olympus, Hydro One, Satyam, Maruti Suzuki)

- Independent director eligibility criteria under Section 149(6) of Companies Act 2013

- Comprehensive coverage of Companies Act 2013 provisions (incorporation, share capital, debentures, deposits, management, accounts, CSR, audits, director appointment and qualifications, related party transactions, director liabilities, board committees, meetings, mergers, oppression and mismanagement)

- SEBI (LODR) Regulations 2015

- Board committee operations and governance

- Financial statement analysis and basic accountancy

- Corporate governance best practices and regulatory compliance framework

- Secretarial Standard 2 and Schedule IV (Code for Independent Directors)

- Professional ethics for independent directors

- Most importantly: How to find your first clients, position your profile, and secure independent director appointments

Faculty: Program instructors include:

- Qualified Independent Directors who have successfully cleared the IICA proficiency test

- Experienced corporate law practitioners with 7+ years of litigation and advisory experience before High Courts

- Teaching professionals with 23+ years of experience in CA, ACCA, IFRS, CPA-USA, and CMA-USA courses

- Senior associates with extensive expertise in company law, corporate affairs, governance, and regulatory compliance

- Practicing professionals with decades of industry experience as company secretaries and legal advisors

Fees: ₹63,000 for the complete program (inclusive of all charges). EMI plans are available in collaboration with financing partners, making the investment more manageable for working professionals..

Certificate: The program is recognized by the National Skill Development Corporation (NSDC), a public-private partnership under the Ministry of Skill Development and Entrepreneurship, Government of India. You receive a co-branded NSDC and Skill India certificate upon successful completion, which carries official government recognition.

Refund Policy: 100% money-back guarantee available after 30 days of full participation if you don’t find the course beneficial. The only condition is that you must pursue it diligently for a month, complete the exercises, but still not find value in it.

Unique Advantages:

- Post-Certification Placement Strategy: Unlike other programs that end with certification, LawSikho explicitly teaches you how to find clients, position your profile, leverage networking, and secure actual appointments. This addresses the biggest gap most certified professionals face—getting from certified to appointed.

- Live Mentorship: The program includes live sessions where you can ask questions about your specific situation—whether that’s transitioning from a corporate role, building your personal brand, or navigating your first board appointment.

- IICA Test Preparation: The curriculum specifically prepares you for the mandatory IICA proficiency test with mock assessments that mirror the actual test format.

Success Stories: LawSikho’s program has enabled Rangaraj Ravindran (CEO of VST Group India), Vivek Suman (Investment Banker), Dilip Sharma (Chartered Accountant) and many more to clear the IICA proficiency test within just three months of joining the course and subsequently enrolled in their Personal Branding program to position themselves for appointments.

Best Suited For: Mid-career to senior professionals (10-25 years experience) in law, finance, management, sales, marketing, research, or related fields who want comprehensive training that doesn’t stop at certification but extends to actual appointment strategy and career placement. The higher fee is justified by the extensive content (1500+ MCQs, 400+ videos, 48 live classes, 7 case studies), long-term access, placement support, and most critically—the post-certification roadmap to securing actual board positions, which is where most other programs leave a gap.

Please note: – Course content, fees, and program structure are subject to updates. For the most current information including batch schedules, enrollment deadlines, and any program modifications, please visit lawsikho.com or click here or search for “ LawSikho’s Independent Director’s professional Development Program” or schedule a counseling call at +91 80474 86192. Registration is non-refundable except under the 30-day money-back guarantee terms.

IOD Directors Orientation Programme

Program Overview: The Institute of Directors (IOD), established in 1990, offers a comprehensive Orientation Programme (Online) to help participants prepare for and pass the IICA online proficiency self-assessment test.

Duration and Format: The program covers 6 comprehensive modules delivered through intensive sessions. Available in both virtual and physical formats, with virtual sessions offering synchronous learning, in-depth knowledge delivery, and one-to-one communication through online query redressal.

Target Audience: Designed for Independent Directors and aspiring Independent Directors who are looking to serve on Boards of Directors and need to qualify the IICA online proficiency self-assessment test.

Curriculum Highlights: The program covers all topics relevant for independent directors qualifying the online test in the first attempt. It includes discussion on mock test papers for the independent directors’ proficiency test.

Faculty: Sessions are conducted by renowned speakers with systematic, synchronous learning approaches. The program provides in-depth knowledge beyond geographical barriers through virtual delivery.

Fees: Program fees is divided in two parts:

- Virtual Programme: Rs. 2.50 Lakh + GST 18% = Rs. 2,95,000 total

- Physical Programme: Rs. 2 Lakh + GST 18% = Rs. 2,36,000 total

Additional Benefits: Participants receive one year complimentary membership of the Institute of Directors (for non-members).

Certificate: IOD certificate confirming program completion and comprehensive test preparation for the IICA proficiency examination.

Flexibility: IOD reserves the right to change course syllabus, content, faculty, locations, and fees. If a registered participant cannot attend, registration is cancelled with no refund. This strict policy reflects the program’s intensive, time-bound nature.

Unique Advantage: Established track record with 430+ batches and 10,000+ executives trained. Comprehensive curriculum designed specifically to align with IICA proficiency test requirements. The program offers systematic coverage of all regulatory, governance, and financial topics tested in the IICA examination, with practical mock test experience and discussion to build test-taking confidence.

Best Suited For: Given the premium pricing (Rs. 2.36-2.95 Lakh), this is best suited for senior executives and professionals for whom board positions represent significant career value and who want expert-guided preparation from India’s established Institute of Directors.

For more information, visit their website by clicking here.

IIM Bangalore Independent Directors Certificate Programme (IDCP)

Program Overview: IIM Bangalore’s Executive Education Programmes Office offers a prestigious Independent Directors Certificate Programme (IDCP) designed to provide comprehensive knowledge about how the real world of corporate governance works and the current and emerging role of Independent Directors.

Duration and Format: The program is a 21-day certificate programme spread over 6 months (November 2025 to April 2026), comprising 35 sessions conducted in hybrid mode. Hybrid delivery means participants can choose to be physically present in the IIM Bangalore classroom or participate virtually via Zoom. The program offers flexibility for working professionals with sessions scheduled on:

- Fridays: 18:00-20:45 (evening sessions to accommodate work schedules)

- Saturdays: 10:00-12:45 & 14:15-17:00 (full-day weekend sessions)

Target Audience: Designed for current independent directors, non-executive directors, professionals aspiring to become independent directors, and researchers in the corporate governance field.

Curriculum Highlights: The program informs participants how the real world of corporate governance works and the current and emerging role of independent directors. It offers a clear perspective on corporate governance with conceptual models for investigating independent director roles and behavior based on both practical insights and academic understanding.

Faculty: Program Directors include Professor S. Raghunath from the Strategy area and Professor Anil B. Suraj from the Centre for Public Policy at IIM Bangalore. Faculty bring both academic rigor and practical board experience.

Fees: IIM Bangalore programs typically command premium pricing. While specific fees aren’t publicly disclosed, the fee for non-residential is INR 4,50,000 + 18% GST = INR 5,31,000 total.

Certificate: IIM Bangalore Executive Education Programme Certificate of Completion awarded to participants at the end of the programme upon successful completion of programme requirements. This carries the prestige and credibility of India’s top ranked business school (QS 2025 Global Full-Time MBA Ranking).

Unique Advantages:

- IIM Brand Equity: An IIM Bangalore certificate carries significant credibility with corporate boards, particularly for those targeting blue-chip company appointments.

- Hybrid Learning Experience: Unlike purely online programs, you experience IIM Bangalore’s campus environment, interact face-to-face with faculty and peers, and build stronger networking relationships.

- Academic Rigor: The program is described as a “unique offering from IIM Bangalore” that combines theoretical frameworks with practical governance challenges.

- Networking: Your cohort comprises practicing directors and senior executives—connections that often lead to board referrals and co-directorship opportunities.

Best Suited For: Senior executives and CXO-level professionals (20+ years experience, current compensation ₹50 lakh+) who want the IIM brand on their credentials and can justify the premium investment through future board portfolio earnings. If you’re targeting Fortune 500 Indian companies and PSU boards, the IIM certificate opens doors.

Please note: The above details are specific to Batch 7 (November 2025 – April 2026). For updated information on subsequent batches including schedules, curriculum modifications, and any changes in program structure or fees, please visit https://eep.iimb.ac.in/ or contact the Executive Education Programmes office directly or click here for Brochure.

KPMG Board Leadership Centre Programme

Program Overview: KPMG India’s Board Leadership Centre has designed the Independent Director Certification Programme to help participants gain comprehensive knowledge on all aspects of board membership and prepare them to effectively carry out their roles and responsibilities as independent directors.

Duration and Format: 10-week program delivered through virtual classroom format with 50+ learning hours (also referenced as 45+ hours in program materials). Weekend classes scheduled over 10 weeks with live virtual instructor-led sessions, allowing working professionals to participate without disrupting their careers.

Target Audience: The program is best suited for senior professionals with 20+ years of leadership experience. KPMG explicitly positions this as a premium offering for CXO-level candidates.

Curriculum Structure: The program covers 18 comprehensive modules:

- Module 1: Introduction to being a board member

- Module 2: Governance frameworks and Independent Director’s position

- Module 3: Finding your place in a board committee

- Module 4: Professional discipline, compliance, and ethics

- Module 5: Interpreting financial statements

- Module 6: Basics of risk and governance

- Module 7: Select regulatory focus areas

- Module 8: Stakeholder management and investor relations

- Module 9: Human capital and diversity

- Module 10: Board effectiveness and evaluation

- Module 11: Anti-bribery, fraud, and corruption

- Module 12: Family business governance

- Module 13: Mergers and acquisitions

- Module 14: ESG (Environmental, Social, Governance)

- Module 15: Cyber security

- Module 16: Digital strategy and transformation using emerging technologies

- Module 17: Getting your first directorship

- Module 18: Continuous professional development

Faculty: Program faculty includes KPMG partners and industry leaders with expertise in corporate governance, board matters, forensics, risk advisory, finance, investor relations, ESG, cybersecurity, accounting, digital transformation, and people management.

Special Feature—Module 17: KPMG uniquely includes a dedicated module on “Getting your first directorship”—addressing the post-certification placement challenge that most programs ignore.

Additional Benefits: Executive search partnerships: KPMG connects participants with executive search firms specializing in board placements. (Note: Executive search partners may change without prior notice).

Important Caveat: Participants must register and undergo the mandatory IICA assessment separately. The KPMG program prepares you for board service but does not directly prepare you for the IICA proficiency test. You’ll need additional IICA test-specific preparation.

Fees: ₹2.75 lakh per participant plus GST approximately INR 3.245 lakh (₹2.75 lakh + 18% GST)

Certificate: Certificate from KPMG India upon program completion.

Unique Advantages:

- Big 4 Credibility: KPMG’s brand carries weight with audit committees and CFOs who value the financial rigor and governance focus of Big 4 firms.

- Executive Search Connections: Access to KPMG’s executive search network could accelerate your first appointment—assuming you meet their client companies’ experience requirements.

- Contemporary Topics: Modules on ESG, cyber security, and digital transformation reflect current board priorities, making you relevant for 2025-2030 governance challenges.

- Peer Network: Your cohort comprises CXO-level professionals who can potentially refer you to board openings in their networks.

Limitations: Unlike other courses, the premium pricing and senior experience requirement exclude mid-career professionals.

- Additionally, the program doesn’t directly prepare you for the IICA test, necessitating separate preparation.

- Non-refundable fee policy means once you pay, there are no refunds regardless of circumstances.

- Selection process includes resume screening, interview, and SOP requirement—not everyone who applies will be accepted.

Best Suited For: CXO-level executives, successful entrepreneurs, and senior consultants (20+ years, compensation ₹75 lakh+) who want Big 4 brand credibility, executive search connections, and are targeting listed company boards or large private companies. The investment makes sense if your professional profile commands ₹1+ lakh sitting fees per board meeting.

Directors Institute Independent Directors Program (IDP)

Program Overview: Directors Institute offers the Independent Directors Program (IDP) to prepare non-executive directors for their crucial role in overseeing corporate governance and preventing mismanagement.

Format: Self-paced online courses accessible anytime, anywhere, designed to allow participants to progress at their own speed without fixed schedules. The program offers 200+ hours of course content that participants can complete according to their availability and learning pace.

Target Audience: Existing independent directors, aspiring independent directors, and professionals across various backgrounds seeking to develop integrated governance thinking and skills.

Curriculum Highlights: The program incorporates key elements from the Companies Act 2013, SEBI’s Listing Obligations and Disclosure Requirements (LODR), and various case studies. It includes more than 24 well-researched modules designed as per industry requirements (referred to as “9 Well Designed 200+ Hours Courses” in their achievements).

Sample modules cover:

- Introduction to board membership roles, responsibilities, and legal obligations

- Principles and practices essential for effective board operation

- Different provisions of Companies Act 2013

- SEBI LODR compliance

- Global best practices in corporate governance

Learning Resources: Different provisions and sections of the Companies Act 2013, SEBI LODR, case studies, and other resources are consolidated in one place for participants’ convenience. Case studies on major corporations provide concentrated reference points for independent directors.

Credibility: Completion of the program enhances professional credibility, setting you apart as a qualified and competent leader. The courses are backed by government and non-government bodies for contributions to economic development.

Fees: Program fees and structure require direct inquiry with Directors Institute.

Certificate: Directors Institute certificate upon program completion.

Unique Advantages:

- Self-Paced Flexibility: No fixed schedules—access courses at your convenience and progress at your own speed.

- Comprehensive Resource Consolidation: Instead of hunting across multiple sources, you get Companies Act provisions, SEBI regulations, and case studies consolidated in a single platform.

- Focus on Crisis Management: The program teaches independent directors the proper approach during conflicts or crises—practical skills often overlooked in academic programs.

Limitations:

- No live instruction or interactive sessions with faculty

- Requires strong self-motivation and discipline to complete

- No specified cohort-based learning or peer networking during the program

- Fees not transparent—requires inquiry

- No information about faculty credentials or backgrounds

- Limited details on assessment methods or program completion requirements

Best Suited For: Professionals seeking affordable, self-paced training who don’t need live instruction or campus experiences. Ideal for those with strong self-discipline and time management skills who can complete online modules independently.

Important Note: For updated information on program fees, detailed module breakdown, faculty credentials, assessment methods, and enrollment procedures, please contact Directors Institute directly through their website or offices. The information above is based on publicly available content on their website and may be subject to change.

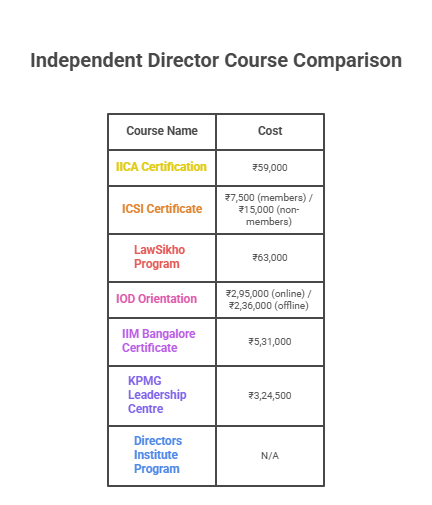

What Should You Look for in an Independent Director Course/Program?

With seven programs ranging from ₹7,500 to ₹5.31 lakh (approx), how do you decide where to invest? Here are the critical evaluation factors:

Syllabus and Core Curriculum Focus

What to Evaluate: Does the curriculum align with your knowledge gaps and career goals?

Red Flags to Avoid:

- Generic “corporate governance overview” without specific module breakdowns

- Heavy theory without practical case studies

- Curricula that haven’t been updated since 2019 (ignoring recent Companies Act amendments and SEBI updates)

Green Flags to Seek:

- Specific modules on contemporary issues like ESG, cybersecurity, digital transformation, and family business governance

- Balance between regulatory compliance (Companies Act, SEBI LODR) and board effectiveness skills

- Case studies from major corporations that provide practical reference points

- Coverage of board committee operations (audit, nomination and remuneration, CSR, risk management)

How to Assess: Request the detailed curriculum before enrolling. Ask for sample module content or preview materials. If a program won’t share its syllabus upfront, that’s a warning sign.

Course Duration and Learning Format

Duration Options:

- Short programs (3 months): ICSI’s part-time certificate course balances work and study

- Medium programs (4 months): IICA programs provide comprehensive learning without excessive time commitment

- Extended programs (6+ months): IIM B, LawSikho’s and KPMG’s program are spread over 6 months.

Format Considerations:

- Fully online/self-paced: Offers maximum flexibility but requires strong self-discipline. You miss networking opportunities.

- Live virtual sessions: Virtual classroom and live format provides instructor interaction and peer engagement while maintaining location flexibility

- Hybrid (campus + online): IIM Bangalore’s model offers the best of both—convenience plus networking through on-campus sessions

Questions to Ask Yourself:

- Can you commit to fixed weekly sessions, or do you need self-paced flexibility?

- Do you value networking opportunities, or is knowledge acquisition your sole priority?

- Will your employer allow study time during work hours, or must you complete training evenings/weekends?

Fees and Financial Considerations

The fee structure of all seven programs as available in the public domain are as illustrated in the table below:

Price Spectrum Analysis:

- Budget-friendly: ICSI (₹7,500 for members, ₹15,000 + GST for non-members),

- High Value: IICA (₹59,000) and LawSikho (₹63,000)

- Premium : IOD (₹2.36 lakh for physical, ₹2.95 lakh for virtual), KPMG (₹3.24 lakh), and IIM Bangalore (₹5.31 lakh) KPMG and IIM Bangalore programs

Hidden Costs to Factor In:

- ₹25,000 for IICA lifetime databank registration (required regardless of training program)

- Travel and accommodation for hybrid programs with campus components

- Opportunity cost of time away from work

Financial Aid Options: LawSikho and KPMG offers EMI plans in collaboration with financing partners, and some employers reimburse executive education expenses. Check your organization’s professional development policy.

Faculty Expertise and Industry Exposure

What Matters in Faculty Credentials:

Academic Credentials Alone Aren’t Enough: A PhD in corporate governance doesn’t necessarily equip someone to teach practical board dynamics. Prioritize faculty with:

- Active or former board experience as independent directors who’ve cleared the proficiency test

- Expertise in specialized areas like forensics, risk advisory, ESG, cybersecurity, and digital transformation

- Combined academic and practical experience (like IIM Bangalore’s professors who also advise corporate boards)

Warning Sign: Programs listing faculty as “industry experts” without naming them or providing credentials. Legitimate programs showcase faculty profiles prominently.

Questions to Ask:

- How many faculty members currently serve or have served as independent directors?

- What percentage of instructors come from academia vs. practicing professionals?

- Will you have access to faculty after course completion for mentorship?

Support Beyond the Course: Networking, Placement, and Visibility

This is where most programs fail—and where your evaluation should focus heavily.

Networking Opportunities:

- Does the program create peer cohorts where you interact with 20-30 other professionals pursuing similar goals?

- Are alumni networks active, or do participants disappear after the program or course?

- Does the platform facilitate ongoing discussions, forums, and community engagement among registered independent directors?

Placement Support:

- Does the program offer executive search partnerships that can connect you with board opportunities?

- Is there a dedicated placement support or a curriculum on “getting your first directorship”—teaching you how to find companies, position your profile, and navigate the appointment process?

- Post-course, do instructors make themselves available for career advice?

Profile Visibility Boost:

- Does completing the program result in certificates co-branded by recognized bodies like NSDC, Skill India, or Ministry of Corporate Affairs?

- Can you feature program completion on LinkedIn and other professional platforms?

- Do companies recognize the certificate when evaluating director candidates?

The Make-or-Break Question: “What happens on Day 1 after I complete your program and want to secure my first independent director appointment?”

If the answer is “you’ll have the knowledge you need,” that’s insufficient. The right answer should include specific strategies: optimizing your IICA databank profile, leveraging program alumni networks, approaching executive search firms, targeting companies in your industry, and using LinkedIn effectively.

LawSikho has a specialized placement support and KPMG addresses this through dedicated curriculum on roadmap to securing appointments, while most other programs end at knowledge transfer.

Which Course/Program is Right for Your Experience Level?

Not every program suits every career stage. Here’s your decision matrix:

Programs for Early-Career Professionals

While the IICA databank has no minimum age beyond 21 years and accepts any bachelor’s degree, companies rarely appoint independent directors with less than 10 years professional experience.

If you have less than 5 Years of Experience:

Should You Get Certified Now? Only if:

- You’re building toward a board career 4 to 5 years from now

- You work in corporate governance, compliance, or legal roles where independent director knowledge enhances current job performance

- You can afford ₹15,000 to ₹63,000/- with emi options

Recommended Programs:

- ICSI Certificate Course (₹7,500 for CS students): If you are pursuing ICSI membership or already qualified, this affordable option builds relevant knowledge early

- Skip premium programs: Investing over ₹2.5+ lakhs now makes no sense when you’re 5-10 years away from realistic appointment

Your priority should be to build board-relevant expertise in your current role. Volunteer for audit committee support work, financial analysis projects, regulatory compliance tasks, or board presentation preparation. This experience will matter more than early certification.

If You’re 5-10 Years into Your Career:

You’re entering the zone where certification makes strategic sense—if you have specialized expertise.

Should you get certified now? Yes, if:

- You are a CA, CS, or lawyer with deep technical expertise companies value

- You have worked in sectors with board compliance complexity (banking, pharmaceuticals, energy)

- You are positioning for smaller company boards or family businesses where 10 years suffices

Recommended Programs:

- ICSI Certificate Course (₹7,500-₹15,000): Cost-effective, compliance-focused training that leverages your existing statutory knowledge

- LawSikho Program (₹63,000): If you’re serious about board career trajectory and value the post-certification appointment strategy that other programs lack

- Avoid (₹2.5 to 5 Lacs+): KPMG, IOD and IIM Bangalore programs explicitly target 20+ years experience —you’d be the junior participant in the room.

Your strategic move at this stage would be to get certified, register with IICA databank, but set realistic expectations. Your first appointments will likely come from:

- Startups where founders value your technical skills over leadership tenure

- Small private companies needing compliance expertise

- Family businesses transitioning to professional governance

Do not expect ₹1 lakh sitting fees—target ₹20,000-₹50,000 range initially.

Mid-Career Professionals (10-20 Years Experience)

This is your optimal certification window. You have enough experience that companies take you seriously but haven’t yet established extensive personal networks that make formal training unnecessary.

So should you get certified now? Absolutely yes, with the right program choice.

Recommended Programs:

Option 1—Budget-Conscious Path: ICSI Certificate Course (₹7,500-₹15,000) + Self-study for IICA proficiency test + ₹25,000 IICA lifetime registration = Total ₹32,500-₹40,000

This works if you are self-motivated and have strong regulatory knowledge from your CA/CS/legal background.

Option 2—Comprehensive Training: LawSikho Program (₹63,000) + ₹25,000 IICA lifetime registration = Total ₹88,000

Choose this if:

- You lack board-specific training and want structured learning

- You value the post-certification appointment coaching that addresses “what happens after I’m certified”

- You’re willing to invest for comprehensive preparation

Option 3—Premium Fast-Track: KPMG Program (~₹3.24 lakh) + ₹25,000 IICA registration = Total ₹3.49 lakh

This makes sense only if:

- Your current compensation exceeds ₹40 lakh and you can justify the investment

- You are targeting audit committee positions where Big 4 credentials help

- Your employer reimburses executive education costs

Your Strategic Priorities:

- Get certified within next 12 months—delaying won’t make you more qualified

- Simultaneously build specialized expertise that differentiates your profile (ESG, cybersecurity, fintech, etc.)

- Start networking actively through industry associations, professional forums, and LinkedIn

- Target your first appointment within 18-24 months of certification

Realistic First Appointment Targets:

- Unlisted public companies with ₹10-50 crore paid-up capital

- Growing startups planning IPOs within 2-3 years

- Regional companies in your home state seeking local expertise

- Family businesses professionalizing governance

Expected Compensation: ₹25,000-₹50,000 sitting fees per board meeting in your early appointments.

Senior Executives and CXO-Level Candidates 20+ Years Experience (CXO-Level):

Premium Course: IIM Bangalore IDCP (~₹5.31 lakh) + ₹25,000 IICA registration = Total ₹5.56 lakh

Choose IIM Bangalore if:

- You’re targeting blue-chip Indian companies and Nifty 50 boards

- You want IIM brand equity on your profile

- You value hybrid learning with on-campus immersion for networking

- Your professional background is general management, strategy, or operations

OR

KPMG Board Leadership Centre (~₹3.24 lakh) + ₹25,000 IICA registration = Total ₹3.49 lakh

Choose KPMG if:

- You are a CFO, CA, or financial executive targeting audit committee positions

- You want Big 4 brand credibility with finance and risk committees

- You value executive search partnerships that can connect you with board opportunities

- Your expertise is in finance, risk, compliance, or forensics

OR

LawSikho’s Cost-Effective Program for Strategic CXOs

While premium programs offer brand equity, LawSikho (₹63,000 + ₹25,000 IICA = ₹88,000) provides exceptional value at the lower end of the pricing spectrum with unique advantages that premium programs often lack:

- Dedicated placement support and profile building services: Unlike programs that end at certification, LawSikho explicitly teaches you how to find clients, position your profile, leverage networking, and secure actual appointments—addressing the biggest gap most certified professionals face

- Post-certification roadmap: Comprehensive guidance on optimizing your IICA databank profile, approaching executive search firms, targeting companies in your industry, and using LinkedIn effectively

- Live mentorship for career strategy: Interactive sessions where you can discuss your specific situation—whether transitioning from corporate roles or building your personal brand

- Extended access: 3 years of online access to updated materials (400+ video lectures, 1500+ MCQs, 200+ notes, 7 major case studies)

- IICA test-specific preparation: Curriculum specifically designed to prepare you for the mandatory IICA proficiency test with mock assessments

Best suited for: CXO-level professionals who prioritize practical appointment strategy over institutional brand equity, or those who want to maximize ROI by investing in placement support rather than credential prestige alone.

What is the ROI of Independent Director Certification?

Let’s move beyond vague “career advancement” promises and calculate actual numbers.

Sitting Fees Structure for Board Meetings

The Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 specify that sitting fees payable to any director for attending a board or committee meeting cannot exceed ₹1 lakh per meeting.

Here’s the current market reality:

Fee Distribution Across Nifty 100 Companies (FY24):

As per an article published on Business Standards, In FY24, 29 Nifty 100 companies paid sitting fees of ₹1 lakh or more per board meeting, up from 21 in FY21 and 26 in FY23. Conversely, 36 companies paid ₹50,000 or less, down from 42 in FY21 and 40 in FY23.

This reveals an upward trend—a 5.4% compound annual growth rate in sitting fees over three years, largely aligned with retail inflation rates.

Typical Fee Ranges by Company Type:

Small Public Companies (₹10-50 crore paid-up capital):

- Sitting fees: ₹10,000-₹25,000 per meeting

- Board meetings: 4-5 per year

- Committee meetings: 3-4 per year (if you’re on a committee)

- Annual potential: ₹70,000-₹2.25 lakh

Mid-Cap Listed Companies (₹50-500 crore market cap):

- Sitting fees: ₹25,000-₹50,000 per meeting

- Board meetings: 4-6 per year

- Committee meetings: 4-6 per year

- Annual potential: ₹2-6 lakh

Large-Cap Listed Companies (₹500+ crore market cap):

- Sitting fees: ₹50,000-₹1 lakh per meeting

- Board meetings: 4-8 per year

- Committee meetings: 5-10 per year (multiple committee memberships common)

- Annual potential: ₹4.5-18 lakh

PSUs and Government Companies: Some PSUs like NTPC pay ₹20,000 per meeting as sitting fees for independent directors, though rates vary significantly across different public sector enterprises.

Regional Variation: Metropolitan boards (Mumbai, Bangalore, Delhi) typically pay 20-40% higher sitting fees than regional company boards.

Annual Retainer Compensation Ranges

Beyond per-meeting sitting fees, independent directors can receive profit-linked commission not exceeding 1% of the company’s net profits.

How Profit-Linked Compensation Works: According to the Companies Act 2013, companies can distribute up to 1% of net profits as profit-linked compensation (PLC) to non-executive directors. However, the 2024 survey found most Nifty 100 companies use only part of that amount for compensating independent directors.

In FY24, 53 companies paid 51-100% of distributable profits as PLC to independent directors (down from 57 in FY22), while 22 companies distributed less than 50% of distributable profits (up from 13 in FY22).

For example, A company with ₹100 crore net profit could distribute ₹1 crore to non-executive directors. If split among 5 independent directors, each receives ₹20 lakh annual profit commission—in addition to sitting fees.

Fixed Retainer Fees (Emerging Practice): While not yet mainstream in India, some companies have begun paying fixed retainer fees to independent directors ranging from ₹5-20 lakh annually, independent of meeting attendance. This practice is more common globally and distinguishes between committee members and committee chairs.

The Real ROI Question: It’s not “how long to recover certification costs?” but “how long from certification to first appointment?”

Realistic Timeline Expectations:

- If you have 20+ years experience + strong network: 3-9 months from certification to first appointment

- If you have 10-15 years experience + moderate network: 9-18 months

- If you have less than 10 years experience + limited network: 18-36 months (or may need to build more experience first)

IICA Proficiency Self-Assessment Test

This is the mandatory test that EVERY aspiring independent director must pass however certain professionals are exempt based on their experience.

Test Structure:

The test consists of 50 multiple-choice questions, each carrying 2 marks, for a total of 100 marks. You must score at least 50% (25 correct answers) to pass. There is no negative marking for incorrect answers.

Topics Covered:

The test is based on all relevant topics for independent directors’ functioning, including: Companies Act 2013 provisions, Securities Laws (SEBI regulations), Basic Accountancy and Financial Statements, Corporate Governance principles, and Board Practices.

Specific areas include:

- Independent director eligibility criteria (Section 149(6))

- Duties and responsibilities (Schedule IV)

- Board meeting procedures and quorum requirements

- Board committee structures and functions

- Related party transactions (Section 188)

- Financial statement interpretation basics

- SEBI LODR compliance essentials

- Conflict of interest management

Test Format and Delivery:

The test is conducted online with remote proctoring. IICA has prescribed mandatory requirements: you must have a webcam on your computer or laptop. During the exam, complete recording is done via webcam. Software installed on your system records your screen to ensure you’re not using other windows during the test.

Three test slots are available daily—morning, afternoon, and evening. You can take the exam from your office or home at your convenience without visiting any test center.

Booking Your Test Slot:

After registering with the IICA databank, you access the test booking portal. You can select your preferred date and time slot based on availability. The system allows you to choose any convenient date subject to slot availability.

Attempts Allowed:

There is currently no restriction on the number of attempts. However, you must take at least a one-day gap between two consecutive test attempts.

Time Limit: You have 75 minutes to complete 50 questions—an average of 1.5 minutes per question. This is ample time for prepared candidates since questions are multiple-choice and don’t require essay responses.

If you are also looking for a detailed study/prepration strategy then check out my article on “Complete Guide to Independent Director Exam: Syllabus, Eligibility & Preparation Strategy”

How to Get Appointed as Independent Director After Certification

Getting certified is Step 1. Getting appointed is the real challenge—and this is where 95% of training programs leave you stranded.

Therefore, pick a course that not just transfers knowledge but also helps you get you first appointment as an Independent Director. Nevertheless, in the following part of the article we will look how exactly companies hunt Independent directors.

How Do Companies Find Independent Directors?

Understanding corporate search behavior helps you position yourself effectively.

Method 1: IICA Databank Searches

Companies register with the IICA databank and receive login credentials for up to two designated officers. These officers use advanced search filters to identify candidates matching specific requirements—industry experience, qualifications, location, skills, language proficiency, committee experience, etc.

When a company searches for “Chartered Accountant + Manufacturing Experience + Bangalore,” your profile appears if you’ve optimized these fields during registration.

Your Action Items:

- Complete 100% of Your Profile: Incomplete profiles rank lower in search results. Fill every field—educational qualifications, certifications, past directorships, industry sectors, functional expertise, languages, achievements.

- Use Keywords Strategically: Companies search using specific terms. Incorporate these naturally in your profile:

- “Audit Committee Experience”

- “SEBI LODR Compliance”

- “Listed Company Background”

- “Mergers and Acquisitions Advisory”

- “Risk Management Expertise”

- “Financial Statement Analysis”

- Industry-specific terms (fintech, pharmaceuticals, renewable energy, etc.)

- Update Regularly: You can edit your profile information anytime after registration except for pre-filled MCA21 data. Regular updates keep your profile active in search algorithms.

- Set Full Visibility: Choose full profile visibility settings rather than restricted access. Companies can’t contact you if they can’t see your details.

Method 2: Executive Search Firms

Premium certification programs like KPMG’s Board Leadership Centre offer executive search partnerships that connect participants with board opportunities.

Your Action Items:

- Identify Relevant Search Firms: Not all executive search firms handle board placements. Target those with dedicated Board Practice divisions.

- Submit Your Profile Proactively: Don’t wait to be discovered. Send your CV and IICA registration certificate directly to search firm board practice heads.

- Establish Relationship: Schedule informational meetings (15-20 minutes) with search consultants. Explain your background, target company types, and board service interests. Even if they have no immediate openings, you’re now in their candidate database.

Method 3: Personal Network Referrals

This remains the most effective appointment method—especially at senior levels.

Your Action Items:

- Inform Your Network: Send targeted emails to 30-50 senior contacts (CEOs, CFOs, fellow directors, investors) announcing your independent director certification and board service interest. Attach your profile summary and IICA registration certificate.

- LinkedIn Optimization: Update your LinkedIn headline to include “Certified Independent Director” and IICA registration number. Add a profile summary paragraph detailing your board service interests and expertise areas.

- Target Company Identification: Create a list of 20-30 companies where you’d add unique value based on industry expertise. Research their existing board composition (look for gaps in expertise). Reach out to their CEOs or board secretaries directly expressing interest.

- Leverage Program Alumni Networks: If you completed a cohort-based program like IIM Bangalore or KPMG, your fellow participants are your strongest network. They hear about board openings before public announcement.

Method 4: Industry Association Channels

Many industry associations maintain informal director candidate pools.

Your Action Items:

- Join Relevant Associations: If you’re in pharmaceuticals, join Indian Pharmaceutical Alliance; if in technology, join NASSCOM; if in finance, join CII or FICCI committees.

- Volunteer for Governance Committees: Industry associations often have corporate governance committees or forums. Volunteer your expertise—this raises your profile among CEOs who attend.

- Speak at Industry Events: Offer to speak on governance topics at industry conferences. This establishes thought leadership and brings companies to you.

Method 5: Direct Approach to Companies

For smaller companies without robust search processes, direct approach works.

Your Action Items:

- Identify Target Companies: Focus on:

- Unlisted public companies approaching ₹10 crore paid-up capital (soon needing independent directors)

- Family businesses transitioning to professional management

- Private equity-backed companies where PE firms mandate independent directors

- Startups planning IPO within 2-3 years

- Personalized Outreach: Send personalized emails to CEOs or board secretaries. Structure as:

(a) How you learned about their company,

(b) Your relevant expertise that matches their business challenges,

(c) Your interest in independent director role,

(d) Request for exploratory conversation,

(e) Attached profile and IICA certificate.

- Provide Value First: Before asking for a directorship, offer a free governance assessment or board effectiveness review. This demonstrates your expertise and builds relationship.

Method 6: Platform-Based Opportunities

Emerging platforms are connecting independent directors with companies:

Your Action Items: Create profiles on these platforms with complete information and IICA registration details.

You can also check out my article on How to become an Independent Director to get more tips on appointment.

What is the Typical Timeline from Certification to First Appointment?

Realistic expectations prevent frustration and premature abandonment.

Timeline by Experience Level:

Fresh Certified Directors (0-5 Years Experience):

- Best Case: 24-36 months from certification to first appointment

- Typical Case: 36-48 months or “not yet”

- Reality: Most companies won’t appoint directors with less than 8-10 years professional experience. Use this time to build expertise, not just chase appointments.

Mid-Career Professionals (10-15 Years Experience):